Download Analyst Report

Prophix versus Vena: a side-by-side comparison

Compare Prophix One vs Vena to see which FP&A platform offers better automation, AI, and scalability.

November 25, 2025There are thousands of software solutions for every business need, but finding one that truly fits your business objectives is another story. If you’re comparing Prophix versus Vena, you’re likely already clear on your goals: better visibility, faster reporting, automated data integration, AI capabilities, and more confidence in your numbers. But which platform will actually help you get there?

Start by grounding your search in your business objectives and finance team’s needs. Ask yourself?

- What are our business goals and reporting requirements?

- How important is scalability as our team, data, and priorities grow?

- Do we need automation and AI to reduce manual work and improve accuracy?

- How complex is your business (multi-entity, multi-currency) and what use cases are you looking to tackle?

- Can this platform help us move from data entry to data-driven decision-making?

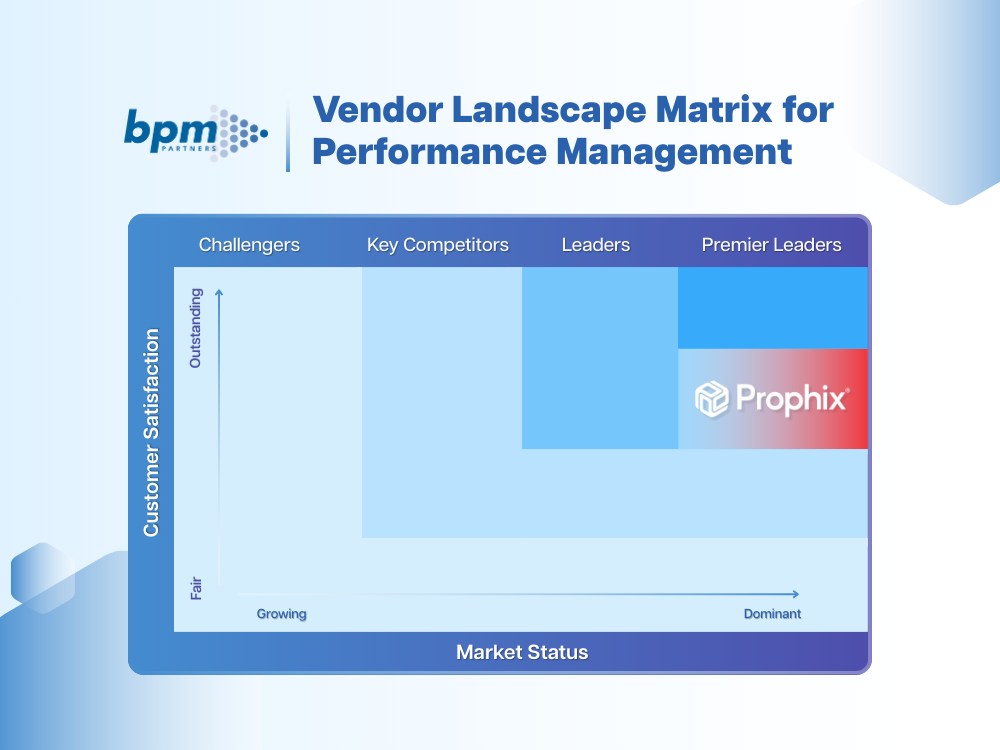

And if you’ve narrowed your search to Prophix versus Vena, you’re on the right track. They’re both leading platforms in financial performance management with the aim of connecting your data, automating processes, and enhancing reporting. But how they do it, and the outcomes you can expect, differ in key ways.

It helps to look at all of the details. That’s why we’ve created a side-by-side comparison of Prophix vs. Vena to help you see what sets them apart and which might be the better fit for your organization.

What is Vena Solutions?

Vena Solutions is cloud-based financial planning and analysis software that offers a comprehensive suite of applications for budgeting, forecasting, reporting, and financial close management. Vena’s software is Excel-based, providing users with a familiar environment while offering powerful capabilities that drive business performance.

Vena reviews from real users

Here is what real users have to say about Vena:

“We retain the flexibility of Excel while benefiting from a collaborative platform that centralizes data and reduces errors. On the other hand, some advanced features require time to master. When the models become very large the loading time can also increase.” - G2 reviewer

“Collaboration with the product allows all levels to view and interact across the business. The time it takes to load templates is too long and makes the budgeting process even more arduous.” - GPI reviewer

The feedback reflects a common theme. Finance teams appreciate Vena’s collaboration features but want less manual effort, faster performance as models grow, and the ability to manage complex use cases. Prophix was designed to meet those needs head-on with built-in automation and seamless scalability. See how you can consolidate data in Excel or level up your reporting with a financial performance platform.

Prophix vs. Vena: How each platform connects, secures, and automates financial data

When evaluating Prophix and Vena, one of the biggest differences is how each platform handles your data, from integration to security. Finance teams need a connected, accurate, and secure source of truth to make confident decisions. We compare how both platforms bring your financial data together, automate key workflows, and maintain data integrity across every process—along with why these differences matter for your business.

Prophix

Vena

Why it matters

Data integration and connectivity

Prophix connects directly with your ERP, CRM, HRIS, and accounting systems to automatically consolidate data in one secure platform. Prophix also supports Excel and CSV imports, SQL, and API connections to nearly any business system, minimizing manual uploads and ensuring real-time accuracy.

Vena integrates with ERP, CRM, and HRIS systems. Data can be imported from Excel, CSV, or SQL databases, but often requires setup and manual refreshes to stay current.

Real-time, automated data integration gives finance teams a single source of truth—reducing manual effort, improving accuracy, and accelerating planning and reporting cycles.

Data accuracy and integrity

Data automatically refreshes on schedule or by trigger, depending on data type. Flat file uploads are also supported. Eliminates manual re-entry and reduces the risk of human error.

Manually trigger data refreshes or set up scheduled updates to reflect the latest data from your source systems.

Automation ensures you have reliable data for decision-making, enabling finance leaders to focus on strategy instead of troubleshooting discrepancies.

Workflow automation

Built-in workflow automation and Task Assistant streamline repetitive tasks and approval flows, helping teams stay on track with deadlines and business objectives.

Built-in automation for headcount planning can model scenarios associated with FTE, like benefits and tax.

Vena’s workflow builder allows users to build process maps, automate repetitive tasks, and track progress but relies more heavily on manual setup and Excel-based tracking.

Automated workflows enhance accountability and efficiency, so teams can close faster and free up time for analysis instead of admin.

Data security and compliance

Enterprise-grade security with SOC 2, HITRUST, and TRUSTe certifications. More information on the certifications we've obtained can be found here.

Security controls can be assigned by user, role, or group, with member-level detail across models.

Basic data security (user permissions, data transfers, and AES 256-bit encryption) with SOC 1 and SOC 2 compliance.

Advanced compliance and granular access protect sensitive financial data and support audit-readiness.

Audit and change tracking

Centralized audit log tracks every addition, change, and user interaction for full transparency and compliance reporting.

Version history tracks changes and time stamps by user, so you can track who accessed the files.

Comprehensive audit trails provide accountability and simplify compliance, ensuring finance leaders can easily trace changes and maintain confidence in reporting.

Prophix vs Vena: Key differentiators at a glance

Both Prophix and Vena help finance teams centralize and manage financial data. Vena is ideal for teams that want to leverage their existing Excel proficiency within a structured, collaborative, and integrated platform. Prophix offers deeper automation, stronger governance, and a unified experience across planning, reporting, and analytics. Prophix is designed to handle complex use cases with more financial and operational data capacity, and Prophix’s explainable AI is backed by TrustArc certification.

For organizations looking to move beyond manual data refreshes and spreadsheet-heavy workflows, Prophix provides a modern, AI-powered CPM platform that scales with your business.

See how Prophix One supports data integration: Book a demo or explore our integration capabilities.

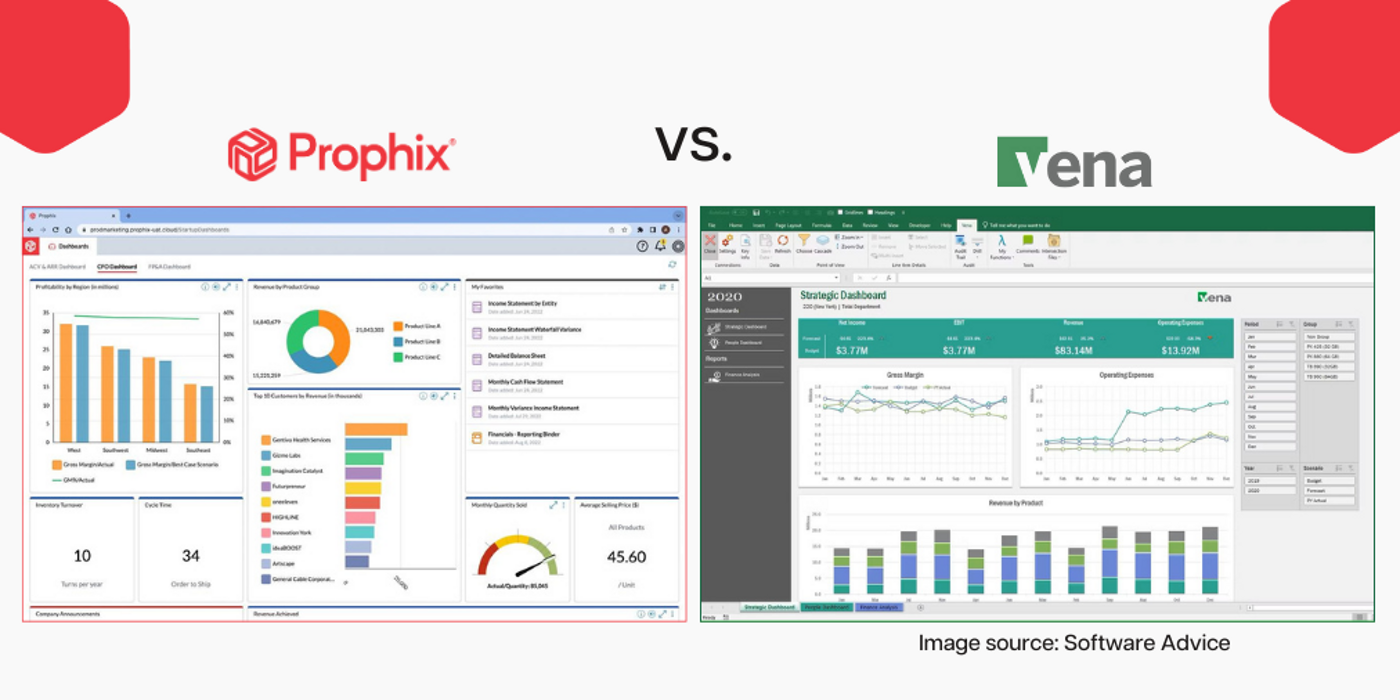

Image source: Software Advice

Prophix One vs. Vena: How each platform powers financial reporting, analysis, and AI insights

When comparing Prophix and Vena for reporting and analysis, the difference lies in how each platform turns your data into actionable insight. Both platforms are considered corporate performance management (CPM) solutions, but Prophix offers more advanced extended planning capabilities that integrate financial and operational data for strategic decision-making. Modern finance teams need automated reporting, predictive analytics, and AI-driven insights that accelerate decision-making and improve accuracy. Below, we compare how both platforms handle analysis, dashboards, and artificial intelligence—and why it matters for your business.

Prophix

Vena

Why it matters

Data analysis and visualization

Unified business intelligence (BI) and analytics are built directly into the Prophix One platform—no add-ons required. Create interactive dashboards, perform ad-hoc analysis, and drill into transactions to uncover insights in real time.

Relies on Power BI for visualization and analysis. Users must export or connect data externally to build dashboards and explore insights.

Embedded BI eliminates the need to switch between tools and removes added complexity. Finance teams can uncover insights faster and make real-time, data-driven decisions.

Custom reporting and dashboards

Build self-serve reports and dashboards using a single source of clean, governed data. Reports refresh automatically on schedule or by trigger, ensuring decisions are based on accurate, current information.

Reporting relies heavily on Excel pivot tables and manual setup. While pre-built templates exist for simple use cases, advanced reports require technical skill and manual maintenance.

Fast, flexible reporting ensures your team always works with the latest numbers. No manual refreshes or Excel maintenance.

Account Reconciliation

Fully integrated, automated reconciliation with configurable dashboards, templates, and transparent controls. Scales easily as your organization grows.

Excel-based reconciliation provides flexibility but limited scalability and visualization.

Integrated reconciliation eliminates disconnected spreadsheets, speeds up month-end close, and scales as your organization grows.

Financial Consolidation

Robust cloud-based consolidation engine supports IFRS, GAAP, and multi-entity reporting. Scales to complex organizational structures with built-in accuracy controls.

Consolidation delivered via partnership with Fluence Technologies. Integrated but requires coordination across separate platforms.

Purpose-built consolidation within the platform reduces dependencies, improves control, and ensures accuracy across global entities.

Artificial Intelligence

Embedded AI across the platform:

Prophix One Intelligence powers narrative insights, predictive forecasting, and automated transaction matching.

Prophix Copilot enables natural-language commands for running processes or distributing reports.

Prophix One Agents (Reporting and Budgeting) are AI-powered teammates, generating insights and updating plans automatically.

Transparent, auditable AI backed by HITRUST CSF and Responsible AI certifications

Vena offers two AI-driven solutions: Vena Copilot and Vena Insights.

Copilot offers AI agents for analysis and reporting. Its Analytics Agent surfaces trends, and its Reporting Agent builds standard Excel reports. Functionality is narrower and less integrated across the platform.

Embedded, explainable AI amplifies finance capacity, shortens close cycles, and increases forecast accuracy, giving leaders confidence in every decision.

Prophix vs. Vena: Key takeaways for reporting and analysis

Both Prophix and Vena help finance teams centralize data for reporting and analysis, but Prophix goes further with built-in business intelligence, unified workflows, and embedded AI. While Vena depends on Excel and Power BI for most analysis, Prophix delivers a complete, governed environment where teams can visualize performance, automate reporting, and leverage AI-generated insights—all in one platform. For finance leaders seeking accuracy, scalability, and modern AI-driven reporting, Prophix provides a more integrated and future-ready solution.

AI advantage: How Prophix One transforms financial planning and reporting

Artificial intelligence is rapidly redefining how finance teams plan, report, and make decisions. While many financial performance platforms are just starting to layer AI on top of existing tools, Prophix One was built with AI at its core — designed to enhance the clarity, capacity, and confidence behind every decision.

Embedded, explainable, and enterprise-ready

Prophix One Intelligence is integrated directly within the Prophix One platform, not as an external plug-in or add-on. Prophix’s glass-box explainability ensures every recommendation and projection is transparent and auditable. Backed by HITRUST and Responsible AI certifications, Prophix One safeguards sensitive financial data while maintaining full regulatory compliance.

Intelligent agents that scale your finance capacity

The Prophix One Reporting Agent and Prophix One Budgeting Agent are your AI-powered teammates, surfacing plain-English insights, generating reports, and updating plans automatically within your governed data environment. These Agents help finance teams reduce manual reporting and reconciliation time while improving accuracy and foresight.

Prophix Copilot: AI assistance in natural language

With Prophix Copilot, users can ask questions, trigger workflows, or distribute reports with natural language queries. Whether you’re verifying a forecast assumption or generating a monthly board report, Copilot removes friction and training barriers, expanding team productivity without adding headcount.

Prophix One offers future-ready finance, today

Prophix’s AI capabilities go beyond automation — they lay the foundation for autonomous finance. By embedding intelligence across planning, reporting, and close processes, Prophix One helps teams move faster, adapt to change, and make confident, data-driven decisions.

In contrast, Vena’s AI capabilities are available primarily through Vena Copilot, a narrower integration that focuses on Excel-based reporting and analytics. While useful for trend detection and report generation, it lacks the unified, platform-wide intelligence and explainability that Prophix delivers.

Take a self-guided tour of the Prophix One Agents and see how you can find better clarity in your data, capacity on your team, and confidence in your decision-making.

Prophix versus Vena: Which solution is right for me?

Ultimately, choosing between Prophix and Vena depends on what your finance team needs today and how far you plan to grow. Prophix and Vena help modern finance teams manage data, automate reporting, and improve accuracy. But if you’re looking for a complete financial performance management (FPM) platform that unifies budgeting, forecasting, planning, reporting, consolidation, and account reconciliation in one place, Prophix One stands apart.

Prophix One combines automation, AI, and scalability to simplify your financial processes and deliver a single source of truth for confident decision-making. As your organization evolves, Prophix grows with you—empowering your team to plan smarter, close faster, and act with clarity.

Moving from Vena to Prophix

Maybe you’ve chosen Vena because it feels familiar. The Excel interface is comfortable, flexible, and quick to adopt. But as your data, team, and processes scale, Excel-based systems can cause friction, and you’ll reach limitations. Prophix One delivers the same flexibility within a secure, unified platform, offering the flexibility you need without fragility.

- Vena offers Excel convenience; Prophix offers a powerful solution for the mid-market to ensure you have the capacity to grow and scale.

- Vena is Excel-dependent infrastructure; Prophix is a cloud-native platform with automation, AI insights, and real-time data integration.

- Vena has add-on AI assistants; Prophix offers embedded AI, including Prophix One Agents for budgeting and reporting, that deliver instant insights.

- Vena requires you to manage Excel templates for reporting; Prophix unifies reporting, budgeting, forecasting, and consolidation within one platform.

- Vena offers basic security and compliance certifications; Prophix has enterprise-grade controls and advanced certifications like HITRUST and TRUSTe.

- Vena works well for mid-sized teams that want to modernize without massive change, Prophix scales effortlessly so you can grow your business without outgrowing your tech stack.

Conclusion: Turning your insights into action with Prophix One

Modern finance teams need more than connected spreadsheets—they need a platform that delivers speed, accuracy, and insight across every stage of planning and reporting. Both Prophix and Vena help teams centralize data and automate workflows, but only Prophix brings everything together in one unified, AI-powered environment built specifically for finance.

With Prophix, you can:

- Automate manual processes across budgeting, forecasting, consolidation, close, and reporting.

- Gain real-time visibility through interactive dashboards and predictive insights.

- Maintain trust and compliance with auditable data and built-in governance.

- Scale seamlessly as your organization grows without outgrowing your platform.

Prophix One is the autonomous financial performance management platform that empowers finance teams to lead with clarity, capacity, and confidence. Whether you’re evolving beyond Excel or re-evaluating your FP&A tech stack, Prophix One gives you the flexibility and intelligence to plan for today and anticipate tomorrow.

Ready to see how Prophix One compares to Vena in action?

Learn how finance leaders are entering the age of autonomous finance with Prophix One.

Prophix vs Vena frequently asked questions

What is the best FP&A software?

The choice for best FP&A software depends on your finance team’s size, complexity, growth plans, and data maturity. For many mid-to-large organizations looking to move beyond spreadsheets, automate budgeting and forecasting, unify planning, reporting, and consolidation on one platform, Prophix One stands out. It offers a cloud-native, unified platform with built-in AI and automation, delivering a single source of truth and scalable processes

Who uses Vena?

Vena is for finance teams who want to stay with an Excel-based interface and UI, while benefiting from many of the standard capabilities that a CPM solution offers. Vena appeals to finance teams seeking familiarity with spreadsheets, though many outgrow its limitations as data volumes and reporting complexity increase.

Who uses Prophix?

Prophix is a finance-owned performance management platform built for growing mid-market organizations with complex operations. When spreadsheets and disconnected systems start holding finance teams back, they switch to Prophix to bring everything together. Prophix automates budgeting, forecasting, reporting, consolidation, and close in one AI-ready platform. The result is real-time insight, greater control, and the flexibility to keep Excel where it helps and replace it where it hurts.

How much does FP&A software cost?

The cost of financial performance management software varies depending on specific factors and requirements, depending on the features and capabilities of the platform, the size of your organization, and your specific needs. Common cost models for FP&A software include subscription-based pricing, tiered pricing, per-user pricing, usage-based pricing, and custom pricing.

Which AI is best for financial analysis?

Prophix combines automation, predictive analytics, and AI to help you spot risks, forecast with confidence, and make fast data-driven decisions. Unlike generic AI assistants, Prophix One Agents work with your financial models and use context-aware insights to give you accurate results your team can rely on.

This blog post was last updated in November 2025 and is part of our ‘Prophix versus’ series. Check out Prophix vs. Planful, Prophix vs. Fluence, Prophix vs. Lucanet, Prophix vs. Onestream, Prophix vs. Cube, Prophix vs. Anaplan, Prophix vs. Datarails, and Prophix vs. Excel.

Insights for next-gen finance leaders

Stay ahead with actionable finance strategies, tips, news, and trends.