Financial Consolidation Software: Prophix versus LucaNet

If you're like most finance pros, choosing the perfect financial consolidation software can feel like finding a needle in a haystack - so many options, so little time.

In this article, we're looking at two choices: Prophix and LucaNet. We'll break down their key features, compare their strengths, and help you decide which one is the right fit for your business.

Whether you're a seasoned pro or dipping your toes into consolidations for the first time, a side-by-side comparison of Prophix versus LucaNet can give you the insights you need to choose.

Database architecture

Prophix

Prophix uses relational database technology, which results in better performance for organizations with larger datasets (>100 entities) and multi-dimensional OLAP cube technology that allows for deeper operational planning capabilities.

LucaNet

LucaNet relies on OLAP technology which allows for in-depth planning capabilities

Data security

Prophix is a fully web-based solution that uses robust data encryption, advanced threat detection, and stringent access control measures to ensure security and privacy for all customer data, including personally identifiable information. We leverage the AWS cloud and have multiple availability zones within the European Union.

LucaNet requires you to install software on your local device, in addition to using their web interface. It uses industry best practices to protect in-company, customer, and partner information. The company is a certified Cloud Service Provider with additional controls to secure the cloud computing environment and personally identifiable information.

Target customer base

Prophix was built for mid-market companies based in North America and Europe that require greater automation due to higher complexity in consolidations.

LucaNet serves mid-market customers across Europe and North America with complex consolidation requirements.

Local support

Prophix has offices in nine countries across Europe with subject-matter experts in the region to provide pre-sales and post-implementation support.

Prophix also offers a Continuous Success Package, which pairs you with a dedicated Customer Success Manager to support your platform journey.

LucaNet has offices in eight European countries and a stable customer support center, with a dedicated Team and Ticket system.

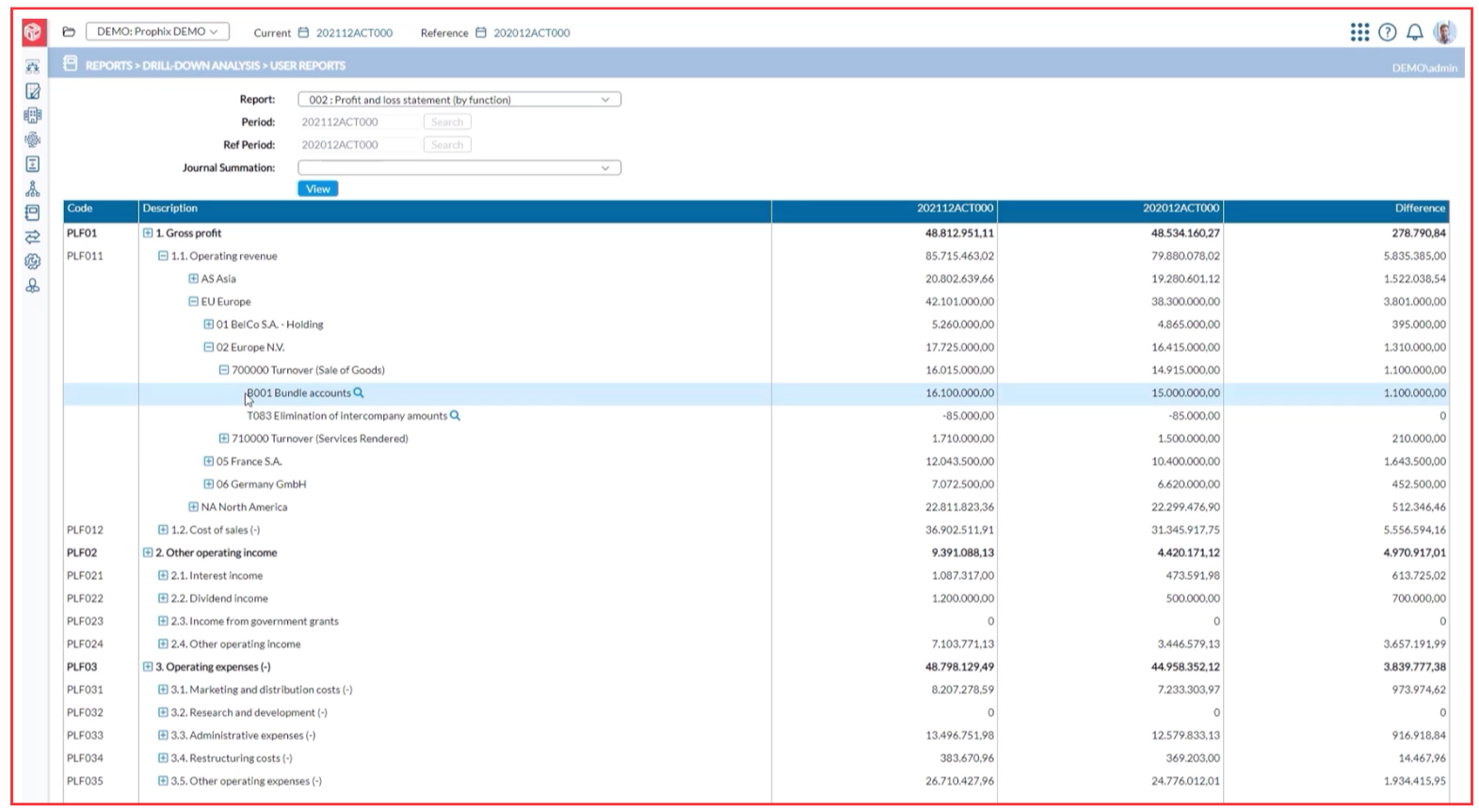

How Prophix and LucaNet analyze data and build reports

Prophix’s Financial Performance Platform stands out with its advanced management reporting, financial planning & analysis, financial consolidation, and intercompany management capabilities.

We also offer a comprehensive data integration capability that allows customers to connect to over 400 systems, leveraging their financial data across all applications with real-time updates throughout the platform.

In terms of financial consolidation, Prophix provides users with the flexibility to adjust the consolidation scope, including participation rates, step-ups, new acquisitions, and de-consolidations. Based on years of field experience, we've also crafted pre-built starter kits for local GAAP and IFRS reporting standards, which contain all necessary base structures for a quick set-up and onboarding process.

In comparison, LucaNet offers more than 250 out-of-the-box connectors for integrating P&L, balance sheet, and cash flow statements. Additionally, it provides pre-built templates for Swiss, German, Austrian, and US GAAPs.

Prophix vs. LucaNet: How do I know which solution is right for me?

Now that you understand how Prophix and LucaNet have built their databases and their unique approaches to reporting and analytics, you can determine which solution is right for you.

LucaNet

LucaNet serves the mid-market and has a large presence in Europe. However, their product has certain disadvantages: it’s lacking in workflow capabilities, no comparable dashboarding, and no ad hoc analysis via drag and drop. With that said, LucaNet offers a consolidation application that has pre-defined templates for local GAAPs and a notes and chart of account structure with excellent out-of-the-box integration capabilities.

Prophix

Prophix’s Financial Performance Platform offers stronger advanced multi-dimensional capabilities, with a built-in logic that is designed to anticipate users’ needs. Our platform has been designed specifically for finance leaders, no matter the size of their organization. It brings together powerful Financial Consolidation, Reporting and Analysis, and Budgeting and Planning applications into one centralized interface. We have designed our Financial Consolidation application to manage higher levels of data complexity and provide greater automation, so that your team can focus on making strategic business decisions, rather than be burdened with manual administrative tasks.

We also offer a Continuous Success Package that provides post-implementation support from our in-house experts who understand how our platform was configured for your needs. This program includes a dedicated Customer Success Manager for your account, unlimited coaching/design sessions with the Prophix team, and a full access pass to Prophix Academy.

The right financial consolidation solution for you

In short, choosing the right financial consolidation software, whether Prophix or LucaNet, should be based on your specific business needs, goals, pricing, and the level of support you require.

Whichever software you choose, implementing consolidation software is a huge upgrade from staying on spreadsheets and can bring your organization immense benefits, including improved accuracy, efficiency, and ability to drive business performance.

Still unsure about financial consolidation software, or struggling to make the business case for your organization? Check out our 12 reasons for investing in financial consolidation software.