It’s Time to Rethink the Way You Budget

Prophix

Oct 20, 2021, 2:25:00 AM

Prophix

Oct 20, 2021, 2:25:00 AM

Budgeting Smarter, Faster, and with Greater Accuracy

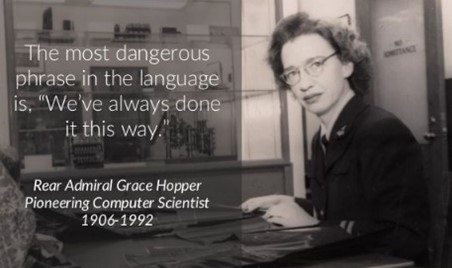

The most dangerous phrase in the English language is, “we’ve always done it this way.” We often hear this adage applied to business, or more specifically, the Office of Finance.

Navy Rear Admiral and American computer scientist Grace Hopper famously rebuked this quote. She started her career when women weren’t recognized as computer scientists, despite designing some of the earliest computers, including Mark 1. She was also one of the first advocates for developing a coding language similar to English, so people could easily understand programming.

In addition to her transformative technology contributions, she was also a mentor and inspiration to the young people she taught and trained. She worked tirelessly to enlighten her pupils of the danger of believing, “we’ve always done it this way.”

Grace Hopper should serve as an inspiration to senior leadership because challenging the status quo is necessary to propel organizations forward. Embracing change and doing away with what you’ve always done has the power to turn laggards into

transformational leaders.

Recognizing the Need for Change in Office of Finance

Always overworked, and in many cases underappreciated, the finance team works diligently to complete the same repetitive tasks every month, quarter, and year. Despite the tedious nature of the work, the tasks get done, and the finance team perseveres.

Until something out of the ordinary happens…such as the financial crisis in 2008/9 or more recently, the COVID-19 pandemic in 2020, which drastically disrupted the markets.

After spending the better part of 2020 improvising financial plans, CFOs recognized the need for “real” budgets that would match resources with strategy. However, many finance leaders realized that traditional budgeting processes were no longer fit for the task ahead.

Many businesses identified a need for greater speed and accuracy to develop budgets amid ongoing uncertainty.

Transforming Budgeting with Technology

While a “perfect” budget may not be feasible –

it is entirely possible to use technology to help facilitate and streamline the budget cycle.

In a recent survey, we found that:

- 79% of finance teams are discontent with their current budgeting tool

- 70% of finance professionals still rely on manual processes and disconnected Excel spreadsheets to conduct their budgeting

- 40% of finance leaders require 90 days or longer to complete their budget

In the face of uncertainty, companies need to not only improve their budgeting but also the accuracy and

frequency of forecasts and

scenario planning.

This is where technology comes in. You cannot use traditional methods and disconnected spreadsheets to conduct advanced accounting techniques. These processes require a purpose-built planning tool that centralizes financial data to support budgeting.

Corporate Performance Management for Budgeting

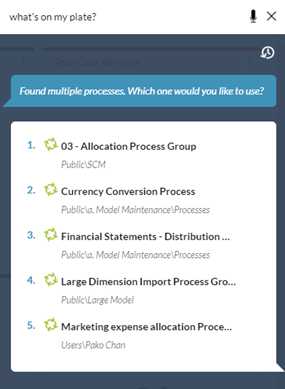

So, how can CPM software transform your budgeting processes?

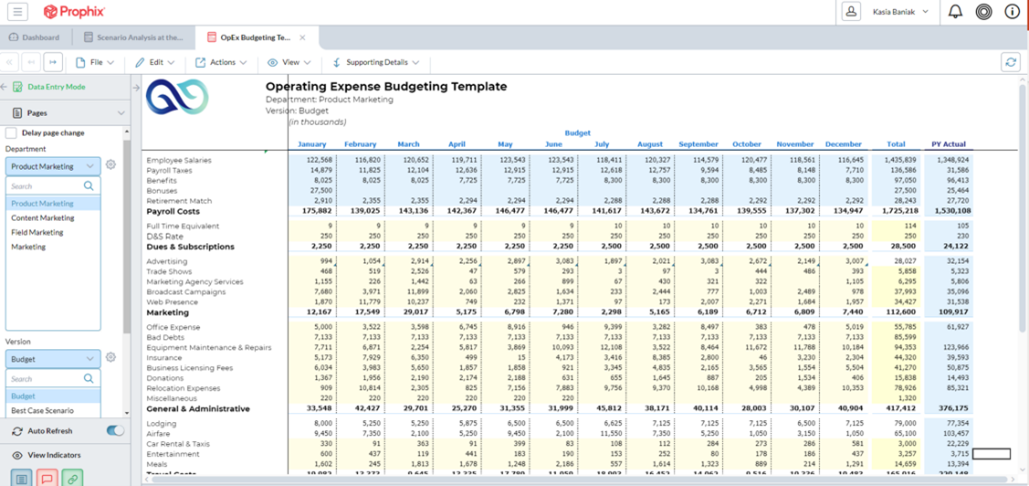

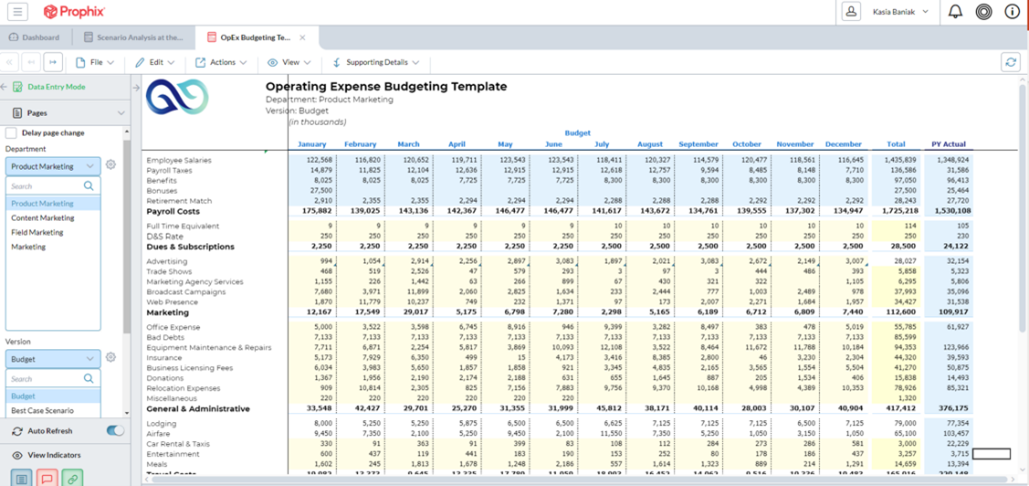

1. Use Cloud-Based Software for Budgeting and Planning

Many CPM vendors offer

cloud-based FP&A platforms that can be implemented without support from your IT department. A cloud-based CPM solution allows team members to securely access budget templates from wherever they’re working – ideal for remote and hybrid work arrangements.

Contributors can make updates to the budget in real-time, which are instantly rolled up or down into the budget's underlying data sources. Finance can easily conduct powerful analysis and spread data (i.e., using historical data like seasonality), eliminating the need for spreadsheets and data imports. Another advantage of

cloud-based CPM is the ability to fall back to a prior budget version, as previous versions live in the cloud.

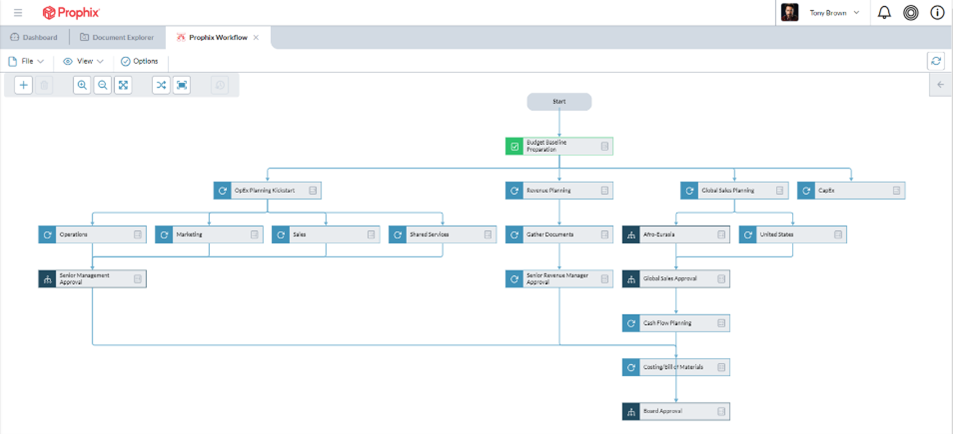

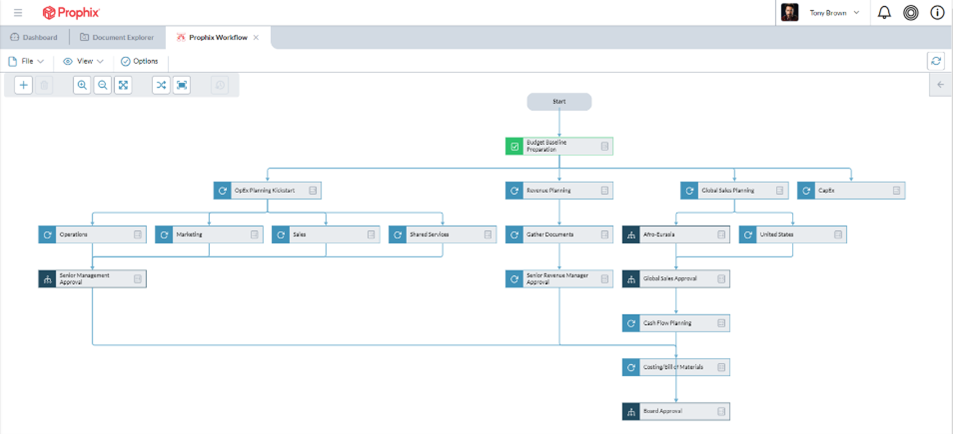

2. Streamline Budgeting with Workflows and Approvals

CPM software automates and streamlines the tedious tasks associated with budgeting. You can automate your budget submissions and reviews with workflows and remove bottlenecks by having a clear picture of what’s left to do in the planning process.

3. Adopt More Advanced Budgeting Techniques

A top-down approach to budgeting requires senior management to develop a high-level budget for the entire organization. In contrast, a bottom-up approach requires managers create a budget and then circulate it for approval.

Zero-based budgeting eliminates the time-consuming nature of both top-down and bottom-up approaches while incorporating a more granular level of detail.

Many finance leaders consider zero-based budgeting laborious because they must justify expenses for each budget period. CPM software can eliminate many of the difficulties associated with zero-based budgeting, enabling organizations to take a more informed approach to their expenses. By simplifying data entry and streamlining the approval process, CPM software can support finance’s adoption of more advanced budgeting techniques.

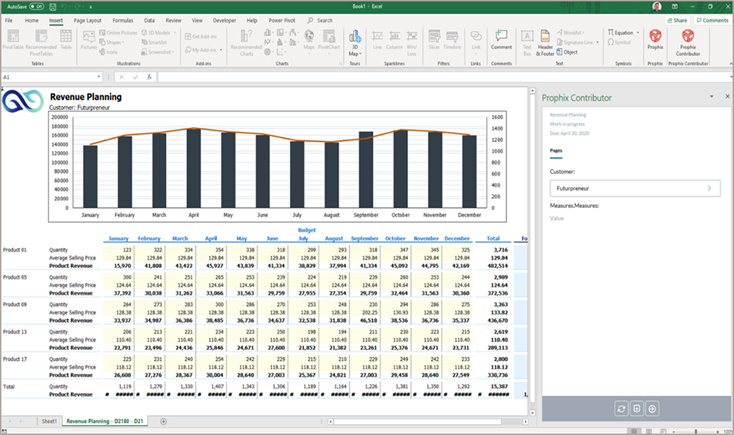

4. Extend Planning Automation to all Contributors

One of the challenges associated with adopting new technology is ensuring everyone can access and understand the software.

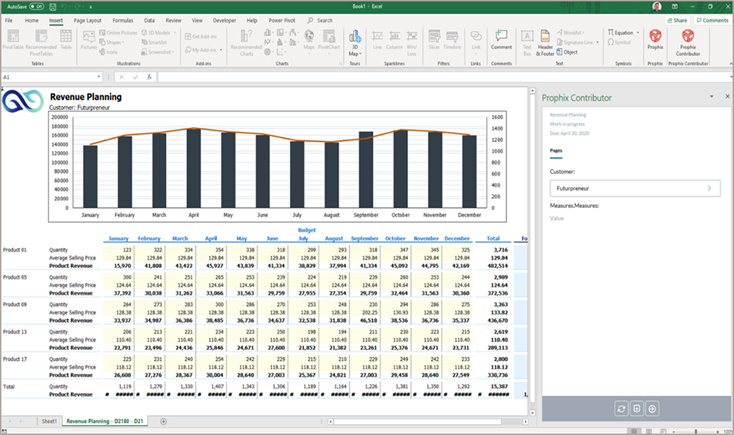

Some CPM vendors offer proprietary user interfaces (web-based) designed to simplify reporting and budgeting. Others use Microsoft Excel as the front-end of their software and add value by providing CPM capabilities as add-ons.

Prophix takes a hybrid approach which includes a web-based interface optimized for finance users and an Excel experience for the occasional budget contributor (i.e., sales and marketing). Regardless of the interface you prefer, a hybrid approach allows you to take advantage of the centralized data and automation capabilities of CPM software to transform the way you budget.

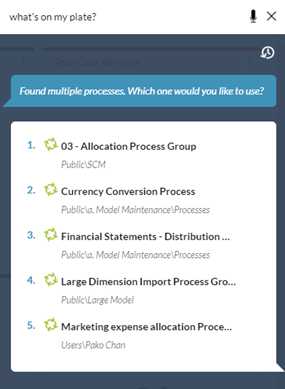

5. Automate Budgeting with Artificial Intelligence (AI)

Empower FP&A

FP&A teams are under a significant amount of pressure to adapt and evolve in the face of uncertainty. It’s no longer possible to resist change by suggesting, “we’ve always done it this way.”

Adopting a Corporate Performance Management (CPM) solution will empower you to budget smarter, faster, and with greater accuracy. This will enable you to become a true strategic partner to the business that supports organizational decision-making and drives success.

Prophix

Ambitious finance leaders engage with Prophix to drive progress and do their best work. Leveraging Prophix One, a Financial Performance Platform, to improve the speed and accuracy of decision-making within a harmonized user experience, global finance teams are empowered to step into the next generation of finance with no reservation.

Crush complexity, reduce uncertainty, and illuminate data with access to best-in-class automated insights and planning, budgeting, forecasting, reporting, and consolidation functionalities. Prophix is a private company, backed by Hg Capital, a leading investor in software and services businesses. More than 3,000 active customers across the globe rely on Prophix to achieve organizational success.

The most dangerous phrase in the English language is, “we’ve always done it this way.” We often hear this adage applied to business, or more specifically, the Office of Finance.

Navy Rear Admiral and American computer scientist Grace Hopper famously rebuked this quote. She started her career when women weren’t recognized as computer scientists, despite designing some of the earliest computers, including Mark 1. She was also one of the first advocates for developing a coding language similar to English, so people could easily understand programming.

In addition to her transformative technology contributions, she was also a mentor and inspiration to the young people she taught and trained. She worked tirelessly to enlighten her pupils of the danger of believing, “we’ve always done it this way.”

Grace Hopper should serve as an inspiration to senior leadership because challenging the status quo is necessary to propel organizations forward. Embracing change and doing away with what you’ve always done has the power to turn laggards into transformational leaders.

The most dangerous phrase in the English language is, “we’ve always done it this way.” We often hear this adage applied to business, or more specifically, the Office of Finance.

Navy Rear Admiral and American computer scientist Grace Hopper famously rebuked this quote. She started her career when women weren’t recognized as computer scientists, despite designing some of the earliest computers, including Mark 1. She was also one of the first advocates for developing a coding language similar to English, so people could easily understand programming.

In addition to her transformative technology contributions, she was also a mentor and inspiration to the young people she taught and trained. She worked tirelessly to enlighten her pupils of the danger of believing, “we’ve always done it this way.”

Grace Hopper should serve as an inspiration to senior leadership because challenging the status quo is necessary to propel organizations forward. Embracing change and doing away with what you’ve always done has the power to turn laggards into transformational leaders.