22 best financial forecasting software for high-impact FP&A (in 2024)

While it's impossible to predict every outcome, being well-versed in financial forecasting can provide you with the necessary tools to plan effectively.

When you know what goes into an effective forecast, you can prepare your business for the future – no matter what’s in store

In this article, we’ll look at:

- What is financial forecasting?

- What is financial forecasting software?

- Benefits of financial forecasting software platforms

- The 22 best financial forecasting software tools for FP&A teams in 2024

- How to choose the best financial forecasting software for your team

- What are the 4 major financial forecasting methods?

- FAQs about financial forecasting software

- Choose the best financial forecasting software for you

At the end of this article, you’ll be equipped with the knowledge to research and choose the best financial forecasting software for you.

What is financial forecasting?

Financial forecasting is the process of predicting—or forecasting—a company's future financial state based on historical data. Financial forecasting is a tool used by management teams to anticipate results and plan accordingly.

What's the difference between forecasting vs. budgeting?

Forecasting looks ahead at a company’s financial future using historical data and trends.

Budgeting estimates your revenue, expenses, and cash flow over a period of time so you can understand how you can reach your financial goals.

Forecasting and budgeting are two processes that work together, since forecasts are used to allocate budgets.

Why is financial forecasting important?

Financial forecasting helps set strategic goals based on current financial standings and historical data. Forecasting also helps make informed decisions that lead to better financial outcomes (because you’re not guessing), which leads to stability and profitability.

How is financial forecasting used in the corporate planning process?

As part of the corporate planning process, financial forecasting evaluates past financial data, combined with current trends, to predict how the company will perform in a specific period.

Examples of financial forecasting in the corporate planning process include:

What is financial forecasting software?

Now that the difference between budgeting and forecasting is clear, and the role that financial forecasting plays in the corporate planning process, let’s discuss financial forecasting software.

What is financial forecasting software?

Financial forecasting software uses your current and historical financial data to quantify trends and business realities, so you can make decisions that drive future performance.

Financial forecasting software can also be referred to as Financial Performance Management (FPM), Corporate Performance Management (CPM), Financial Planning & Analysis (FP&A), or Enterprise Performance Management (EPM) software.

Why is financial forecasting software essential?

Financial forecasting software is a crucial tool for any business hoping to remain competitive and efficient. With the increasing complexity of forecasting demands, the traditional methods of static or fixed forecasts are no longer effective. The introduction of rolling forecasts, which continuously update data to reflect even minor changes in business or market dynamics, provides a more robust and insightful understanding of future trends.

Beyond providing up-to-date forecasts, financial forecasting software can also offer significant time-savings. Automated data collection from various sources eliminates the need for manual data entry, leading to more accurate forecasts. It also improves collaboration and efficiency across teams by setting task owners and approvers, making it easier to track deadlines.

The flexibility provided by financial forecasting software allows for customization of planning models to meet unique business needs. Whether your approach is 'top-down' or 'bottom-up', you can plan your way. This flexibility, coupled with increased accuracy and speed, makes financial forecasting software an indispensable asset for businesses navigating the complexities of modern markets.

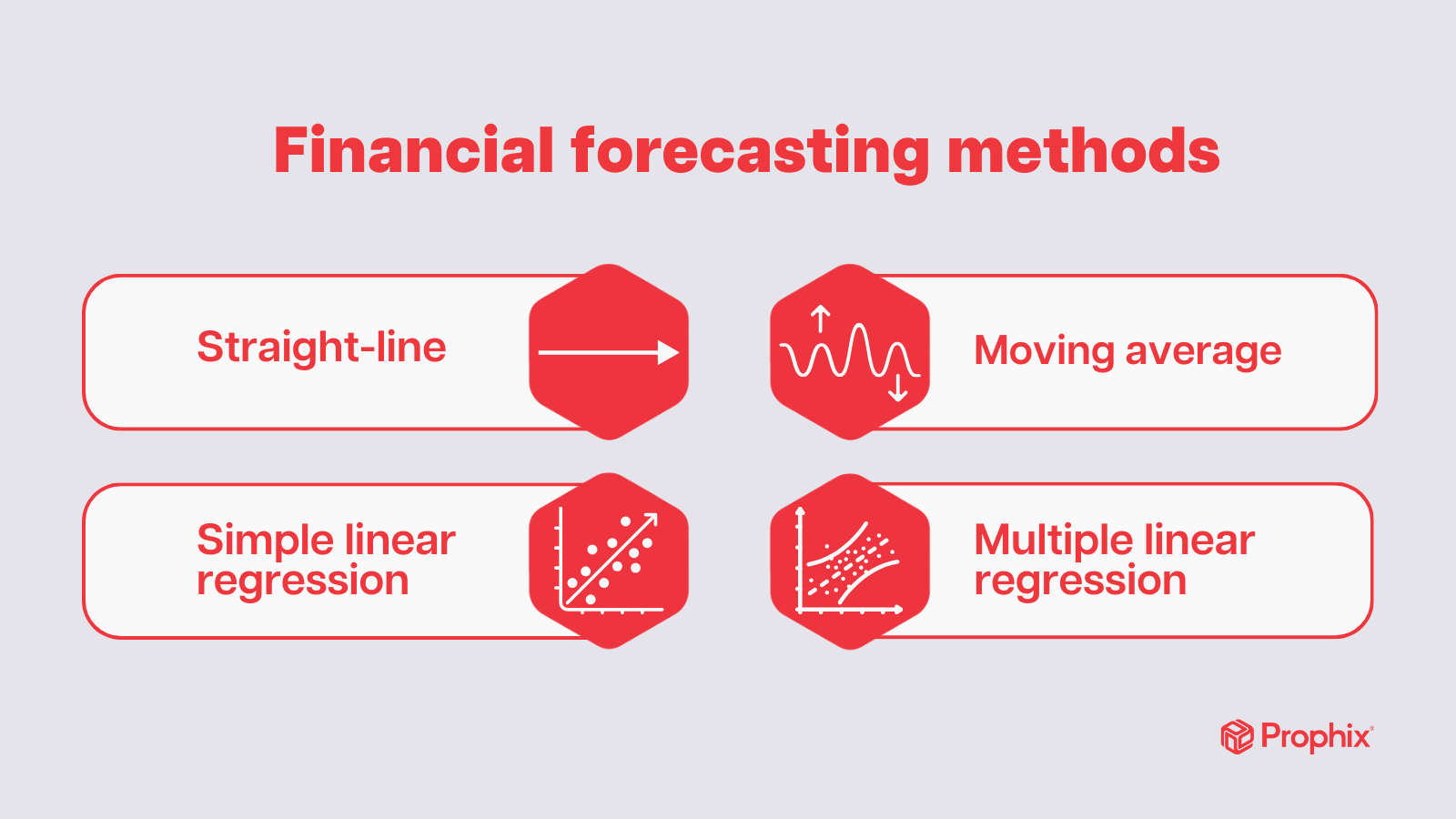

What are some financial forecasting methods?

Financial forecasting uses a range of methods to predict future trends, including:

- Straight-Line - assumes that growth will continue at the same rate, providing a quick and simple forecast.

- Moving Average - smooths out short-term fluctuations and highlights longer-term trends by averaging a certain number of periods.

- Simple Linear Regression - uses statistical techniques to predict one variable based on its relationship with another

- Multiple Linear Regression - extends the concept of Simple Linear Regression by considering multiple influencing variables.

Benefits of financial forecasting software platforms

For businesses who want to predict and prepare for the future, there’s several benefits of financial forecasting software platforms.

Forecast more frequently, in less time

For forecasts to be valuable, they have to reflect the current market trends, which are always changing. The most strategic organizations can consistently update their rolling forecasts with new data, thanks to financial forecasting software, which improves your ability to react to organizational change.

Increase forecast accuracy

When you forecast in spreadsheets, you run the risk of carrying errors forward or making decisions based on inaccurate or out-of-date data. With financial forecasting software, you can be confident that your data integrity is intact, and that you’ll be alerted of any anomalies.

Increase flexibility with top-down and bottom-up planning

Financial forecasting software gives you the flexibility to choose the planning method that works best for your business. Top-down is when objectives are set by upper management and then broken down into steps for lower-level employees. Bottom-up is where each department creates its own forecast that rolls up into a company-wide forecast. This adaptability allows you to adjust your strategy and ensures alignment with your business goals.

The 22 best financial forecasting software tools for FP&A teams in 2024

Let’s look at the 22 best financial forecasting software tools for FP&A teams in 2024.

1. Prophix

Prophix’s Financial Performance Platform empowers finance teams with financial forecasting, budgeting, planning, reporting, analytics, consolidation, and intercompany management functionality.

Best for: Prophix has been designed with the needs of the Office of the CFO in mind, including CFOs, financial analysts, controllers, CIOs, and business leaders.

Features:

- Rolling forecasts that allow you to work with constantly updated data to reflect even the slightest changes in your business or market dynamics

- Automation and integration capabilities automatically pull data from multiple sources to create accurate forecasts

- Use intelligent, AI-powered insights so you can spot trends faster, shrink reporting windows, and improve collaboration and alignment

Pros:

- Easy to add, remove, or alter your structure without help from consultants

- No manual intervention required to produce monthly reports

- Create complex forecasts with many different expense allocations

Integrations:

- Pre-built connectors for your CRM, ERP, and HRIS systems

- APIs to connect to almost any business system

Pricing: Pricing is affected by the number of users, integrations, and use cases. Chat with a Prophix expert to learn more.

2. Planful

Planful helps businesses drive peak financial performance and is used around the globe to streamline business-wide planning, budgeting, consolidations, reporting, and analytics.

Best for: FP&A teams in mid-sized organizations.

Features:

- Pre-built templates

- Financial planning

- Rolling and driver-based forecasting

- Self-service reporting

- Ad hoc analysis

Pros:

- Highly configurable

- Integration with Microsoft Office

- Easy to build and send out reports

Cons:

- Workforce planning is very manual

- No way to organize scenarios into a structure

- Difficult learning curve

Integrations:

- Finance and accounting systems

- ERP, CRM and IT data

- HRIS and ATS software

- Data warehouses and BI tools

- Spreadsheets

Pricing: Planful doesn’t disclose its pricing.

Planful vs. Prophix

See how Prophix compares to Planful.

3. Workday Adaptive Planning

Workday is a provider of enterprise cloud applications for finance, helping customers adapt and thrive in a changing world. Workday applications for financial management, planning, spend management, and analytics are built with artificial intelligence and machine learning.

Best for: Large enterprise finance teams.

Features:

- Financial planning

- Workforce planning

- Operational planning

Pros:

- Collaborative budgeting and forecasting

- Can export reports to PDF or Excel

Cons:

- Difficult to customize after the initial setup

- Challenging to format reports

- Formulas are specific to Workday Adaptive Planning

Integrations:

- Connect with any application, whether it's cloud-based, on-premise, or a file-based data source.

Pricing: Pricing isn’t available on their website, but they do offer a free trial.

Workday Adaptive Planning vs. Prophix

Prophix was developed with a focus on open integrations so it can connect with nearly all existing ERPs. Workday Adaptive Planning has been built to function exclusively with the Workday ERP.

4. Causal

Causal replaces your spreadsheets with a better way to build models, connect to data (accounting, CRM), and share dashboards with your team.

Best for: Financial modelers, business teams, and executives.

Features:

- Dynamic modeling

- Revenue modeling

- Interactive dashboards

- Multi-currency, multi-entity consolidation

Pros:

- Easy to create and save multiple scenarios

- Building models is fast

- Work-group collaboration functionality

Cons:

- Steep learning curve

- Limited functionality as Causal is new to the software space

- No export to Excel functionality

Integrations:

- Spreadsheets and CSV files

- Accounting and ERP software

- Data warehouses and BI tools

- CRM and HRIS software

Pricing: Causal offers three pricing plans – Free ($0/month), Launch ($250/month), and Growth (contact for a quote).

Causal vs. Prophix

Causal is new to the FP&A software space, which means their product is lacking some key functionality. Prophix has over 30 years of experience and a full range of functionality in its Financial Performance Platform.

5. Mosaic.tech

Mosaic’s Strategic Finance platform provides finance and business leaders with a real-time analytics and planning platform that helps teams get from data to decision, faster.

Best for: Finance teams, CFOs, business operations, and CEOs.

Features:

- Financial analysis

- Financial modeling

- Top-line planning

- Custom metrics

- Investor and board reporting

- Close and consolidation

- Cross-functional insights

- Collaborative budgeting

Pros:

- Live integrations

- Streamlines forecasting

- Ability to create custom metrics for your business

Cons:

- Cannot compare forecasts in the same view

- Unable to auto-schedule report distribution

- Must contact support to add new fields

Integrations: Mosaic integrates with ERP, CRM, HRIS, billing software, and data warehouses.

Pricing: Mosaic offers two plans – Foundation and Growth. You have to chat with their team to get specific pricing information.

Mosaic.tech vs. Prophix

Mosaic.tech does not integrate with Excel spreadsheets and requires you to contact support to make changes to your models, which is why Prophix is the preferred option for financial forecasting.

6. Datarails

Datarails is an FP&A software solution providing finance experts with an easy way to conduct FP&A, budgeting, and forecasting.

Best for: Finance and accounting teams at small and medium-sized businesses.

Features:

- Consolidation

- Financial reporting and monthly close

- Planning, budgeting and forecasting

- Analysis and scenario modeling

- Data visualization

- Sales commission

Pros:

- Automated report distribution

- Excel-based formulas

- Streamlined workflows

Cons:

- Lack of training materials

- Difficult to manage integrations

- No predictive analytics, which makes it difficult to forecast

Integrations:

- 70+ plus integrations, including BambooHR, Oracle NetSuite, HubSpot, and OneDrive.

Pricing: Datarails offers custom packages and pricing to fit your needs.

Datarails vs. Prophix

Prophix’s forecasting, budgeting, and planning capabilities stand out when compared to Datarails’ software.

7. Cube Software

Cube is a Financial Planning and Analysis platform that combines the user-friendliness of spreadsheets with the scalability and management features of performance software.

Best for: Cube is best for small businesses and startups.

Features:

- Reporting and analytics

- Planning and modeling

- Centralized data management

Pros:

- Quick to implement

- Drill down to line items

- Integration with Excel and Google Sheets

Cons:

- Slow to load data, which impacts month-end close deadlines

- Lacking robust forecasting capabilities

- Difficult to customize reports

Integrations: Spreadsheets, accounting & finance, HR/ATS, and Billing and Operations, Sales and Marketing, and Business Intelligence software.

Pricing: Choose from Essentials ($1,250/month), Premium ($2,450/month), and Enterprise.

Cube Software vs. Prophix

Reviewers prefer Prophix’s forecasting, workflow, and data visualization capabilities over Cube.

8. Vena Solutions

Vena empowers businesses to Plan for Anything™ with the only native Excel Complete Planning platform built for Microsoft 365 with Power BI embedded.

Best for: Small to medium-sized businesses who use Excel for FP&A.

Features:

- Budgeting and forecasting

- CapEx planning

- Revenue planning

- Workforce planning

- Allocations

- Scenario planning

- Cash flow planning

- Rolling forecasting

Pros:

- Single source of data truth

- Dynamic reports

- Easy to setup forecasts

Cons:

- Interface can appear low-tech because it’s rendered in Excel

- Slow support response times

- Steep learning curve, even with prior knowledge of Excel

Integrations: On-premise source systems, including SAP, Microsoft SQL Server, Oracle, and Sage.

Pricing: Reach out to Vena for more information on their two pricing tiers – Professional and Complete.

Vena Solutions vs. Prophix

See how Vena Solutions measures up to Prophix.

9. Centage Planning Maestro

Centage Planning Maestro is a cloud platform for modern planning and analytics that transforms how companies budget, forecast and report performance.

Best for: Finance and accounting teams

Features:

- Consolidation

- Budgeting

- Forecasting

- Scenario planning

- Dashboards

- Reporting

Pros:

- Ability to create fast, accurate scenarios

- User-friendly

- Granular forecasting

Cons:

- No copy/paste feature

- Poor customer support

- Difficult to setup integrations

Integrations:

- Abila

- Microsoft Dynamics 365

- NetSuite

- Acumatica

- Sage

Pricing: Centage offers three pricing tiers – Standard ($950/month), Professional ($1950/month), and Enterprise (contact them for details).

Centage Planning Maestro vs. Prophix

Users find that Prophix meets their requirements, is easier to use, and simpler to setup than Centage Planning Maestro.

10. PlanGuru

PlanGuru is budgeting, forecasting, and financial analytics software to help make business planning easier.

Best for: Small businesses, accountants, business advisors, and nonprofits.

Features:

- Budgeting and financial analytics

- Rolling forecasts

- Strategic planning

Pros:

- Handles complex forecasting methodologies

- Able to roll up divisions and subsidiaries into higher-level organizations

- Cost effective

Cons:

- Lacking report customization

- Manual data imports

- Functionality differs between desktop and browser versions

Integrations:

- QuickBooks

- Excel

- Xero

Pricing: PlanGuru has two pricing tiers – Single Entity ($99/month) and Multi-Department Consolidations ($299/month).

PlanGuru vs. Prophix

Reviewers find Prophix’s Financial Performance platform easier to use and find the implementation process faster than PlanGuru.

11. Budgyt

Budgyt is fully cloud-based, multi-department budgeting, agile forecasting, and granular reporting tool.

Best for: CFOs, CEOs, marketing directors, IT directors, and COOs who work for small-medium sized businesses, nonprofits, or larger enterprises.

Features:

- Agile planning

- Dynamic forecasting

- Balance sheet and cash flow

- Advanced visuals

Pros:

- User-friendly

- Training resources

- Easy to input data

Cons:

- Does not integrate with major ERPs

- Limited payroll and personnel planning

- No real-time updates

Integrations:

- Inuit QuickBooks

- Xero

- ConnectWise

Pricing: Budgyt outlines three pricing packages on their website, including Easy, Plus, and Pro, although no specific prices are listed.

Budgyt vs. Prophix

Although Budgyt may be ideal for companies that house their data in QuickBooks, it lacks integrations with most other major accounting software, which is a feature of Prophix.

12. LiveFlow

LiveFlow syncs real-time data from accounting services, banks, and payment platforms into custom reports to automate workflows, consolidate accounts, and allow for more collaboration.

Best for: Finance teams that rely on Google Sheets and QuickBooks.

Features:

- Compare budget vs. actuals

- Cash flow forecasting

- Account consolidation

Pros:

- Eliminates the need for manual updates

- Customizable reports

- Ability to drill down and view detailed transaction reports in QuickBooks

Cons:

- Uncategorized transactions cause confusion

- Limited templates

- Not compatible with Excel

Integrations:

- QuickBooks

- Google Sheets

- Xero

Pricing: LiveFlow offers three pricing tiers: Professional ($481/month), Team ($1,100/month) and Organization ($2,000/month).

LiveFlow vs. Prophix

LiveFlow only works well with QuickBooks and Google Sheets. Prophix integrates with hundreds of data sources and systems, so you can get a holistic picture of your business performance.

13. Pigment

Pigment is a business planning platform that brings together people, data, and processes into an integrated platform where teams can quickly build trusted strategic and operational business plans to drive growth.

Best for: Decision-makers across finance, sales and revenue, and HR teams.

Features:

- Collaborative budget planning

- Rolling forecast

- Budget variance analysis

- Revenue planning

- P&L, cashflow, balance sheet forecasting

Pros:

- Cross-functional collaboration between finance and HR

- Automated data import/export

Cons:

- Hard to follow update history

- Solution is fairly new so many features are still being developed

Integrations:

- Looker

- Workday

- Google Sheets

- NetSuite

- BambooHR

- Greenhouse

- Snowflake

Pricing: Choose from Pigment’s Essentials, Professional or Enterprise plan. You can contact them for a quote for specific prices.

Pigment vs. Prophix

Pigment is a new player in the finance software space, whereas Prophix has been a Financial Performance Management vendor for over 30 years.

14. Oracle Essbase

Oracle Essbase gives organizations the power to rapidly generate insights from multidimensional data sets using what-if analysis and data visualization tools.

Best for: Enterprise organizations.

Features:

- What-if analysis

- Complex hierarchy modeling

- Advanced analytical calculation engine

Pros:

- Effective data management

- Ability to connect multiple databases

- Flexible reports

Cons:

- Time-consuming to implement

- Steep learning curve

- Slow to export data

Integrations: No integrations listed.

Pricing: Essbase does not publicly publish pricing plans. Pricing is based on user needs and varies by unit price.

Oracle Essbase vs. Prophix

Oracle Essbase is ideal for enterprise companies, whereas Prophix is better for mid-market companies.

16. Oracle NetSuite Budgeting and Planning

NetSuite Planning and Budgeting automates planning and budgeting processes so finance teams can model what-if scenarios and generate reports — all within one collaborative, scalable solution.

Best for: Ideal for small to medium-sized businesses.

Features:

- Budgeting and forecasting

- Scenario planning and modeling

- Revenue and workforce planning

Pros:

- Easy to use

- Customizable dashboards

- Audit trails

Cons:

- Capabilities lag behind competitors

- Challenging to build custom reports

- Must purchase additional modules for extra functionality

Integrations: Oracle Netsuite Planning and Budgeting does not list their integrations on their website.

Pricing: Oracle Netsuite Planning and Budgeting does not have pricing information available on their website.

Prophix vs. Oracle Netsuite Budgeting & Planning

Oracle Netsuite is considered Enterprise Resource Planning (ERP) software, whereas Prophix is a Financial Performance Platform. Prophix integrates with Netsuite to accelerate data-driven decisions.

17. Jirav

Jirav is a budgeting, forecasting, dashboarding, and analytics solution.

Best for: Small to medium-sized companies and accounting firms.

Features:

- Rolling forecasting

- Scenario planning

- Financial and management reporting

Pros:

- Responsive customer support

- Price forecasting

- Easy-to-use workflows

Cons:

- Not ideal for large data sets

- Limited customization for dashboards

- Forecasting is limited to three years

Integrations: Jirav’s most popular integrations are QuickBooks, ADP, Paychex, Salesforce, HubSpot, and Google Sheets.

Pricing: Jirav offers a free trial, and you can contact them via their website for more information on pricing.

Jirav vs. Prophix

There’s no limit to the number of years you can forecast in Prophix, making it a stronger choice for financial forecasting than Jirav.

18. OneStream

OneStream provides an intelligent finance platform built to enable confident decision-making and maximize business impact.

Best for: OneStream is best suited for enterprises.

Features:

- Strategic and predictive modeling

- Scenario planning

- Personnel, sales, and cash planning

Pros:

- Easy-to-use workflows

- Streamlined financial forecasts and plans

- Account reconciliation

Cons:

- Reporting layouts

- Outdated documentation

- Difficult to create dashboards

Integrations: OneStream integrates with QAD Adaptive ER, PPLEX, SAP S/4HANA Cloud, Oracle Fusion Cloud ERP, Oracle JD Edwards EnterpriseOne, Oracle PeopleSoft ERP, Microsoft Dynamics 365, and Workday Financial Management.

Pricing: OneStream does not publish their pricing on their website.

OneStream vs. Prophix

OneStream is an enterprise solution, whereas Prophix is best suited to the mid-market.

19. OnPlan

OnPlan FP&A software layers on the visualizations, integrations, and collaboration to spreadsheets to take your insights to a new level.

Best for: OnPlan is suited to small businesses (50 employees or less) and heads of FP&A, VPs of finance, and corporate controllers.

Features:

- What-if planning

- Variance analysis

- Automated allocations

Pros:

- Advanced financial modeling and predictive analytics

- Financial forecasting

- User-friendly

Cons:

- Uses the Google Sheets interface

- Not suited for complex financial models

- Limited data integration

Integrations:

- Sage

- Salesforce

- CSV files

- Bamboo HR

- Google Sheets

- Microsoft Excel

- Google Slides

- Netsuite

- BigQuery

- Quickbooks

- Xero

Pricing: Choose from OnPlan’s Essentials, Growth, or Growth+ plans. You must request a quote on their website for specific pricing.

OnPlan vs. Prophix

OnPlan is new to the financial forecasting software space and does not have many user reviews available. In contrast, Prophix has over 30+ years of experience and numerous happy customers who can attest to the platform’s value.

20. SAP Business Planning and Consolidation (BPC)

The SAP BPC software is a comprehensive solution offering planning, budgeting, forecasting, and financial consolidation features all in one platform. It simplifies the modification of plans and forecasts, accelerates budget and closing cycles, and assists in maintaining compliance with financial reporting norms.

Best for: Business executives in mid-to-large size companies.

Features:

- Unified planning and consolidation

- Microsoft Office and web reporting

- Budgeting and forecasting

- Built-in financial intelligence

- Legal and management consolidations

Pros:

- Real-time data access

- Planning and consolidation in a single tool

Cons:

- Reliant on IT to update

- User interface is difficult to navigate

- A lot of manual effort is required to build reports

Integrations:

- SAP and non-SAP data systems

Pricing: There is no pricing available online, but you can request a demo or contact their sales team.

SAP Business Planning and Consolidation (BPC) vs. Prophix

Compare Prophix with SAP Business Planning and Consolidation (BPC).

21. IBM Planning Analytics

IBM Planning Analytics is an AI-infused integrated business planning solution that turns raw data into actionable insights.

Best for: IBM Planning Analytics is ideal for group business controllers, payroll specialists, project managers, and lead finance analysts.

Features:

- Financial profitability plans

- AI-enhanced financial forecasts

- Ad-hoc financial reports and visualizations

Pros:

- Automated model creation

- Real-time calculations

- Collaborative sales & revenue forecasts

Cons:

- Limited data integrations

- Lack of training materials

- Steep learning curve

Integrations:

- Flat files, such as spreadsheets, word docs, budgeting and forecasting applications, as well as ERP, CRM and any API can be integrated by IBM Planning Analytics with Watson.

Pricing: IBM Planning Analytics has three pricing tiers, including: Essentials (up to 5 users; $825.00 a month), Standard (up to 10 users; $1650.00 a month), and Premium, which requires you contact them for a quote. They also offer a free trial.

IBM Planning Analytics vs. Prophix

When comparing Prophix vs. IBM Planning Analytics, users prefer Prophix’s report outputs and scheduling, mobile capabilities, and integrations with third-party data sources.

22. Anaplan

Anaplan’s Connected Planning Platform transforms how you see, plan, and lead your business.

Best for: Anaplan is suited to CFOs, heads of finance, group controllers, and directors of FP&A.

Features:

- Advanced modeling engine for accurate forecasting

- Real-time insights

- Profitability analysis

- Extended planning and analysis

Pros:

- Real-time report updates

- Improves collaboration across departments

- Standardizes forecasting processes

Cons:

- Dashboard functionality is not flexible

- Difficult to scale

- Data latency

Integrations:

- Informatica

- MuleSoft

- Dell Boomi

- SnapLogic

- Tableau

- Microsoft Power BI / Microsoft Dynamics 365

- Workfiva

- DocuSign

- Transactional APIs

Pricing: Anaplan offers three different pricing tiers: Basic, Professional, and Enterprise. For specific pricing, you must request a quote.

Anaplan vs. Prophix

Finance leaders prefer Prophix’s ease of administration, quality of support, and rolling forecasts when compared to Anaplan.

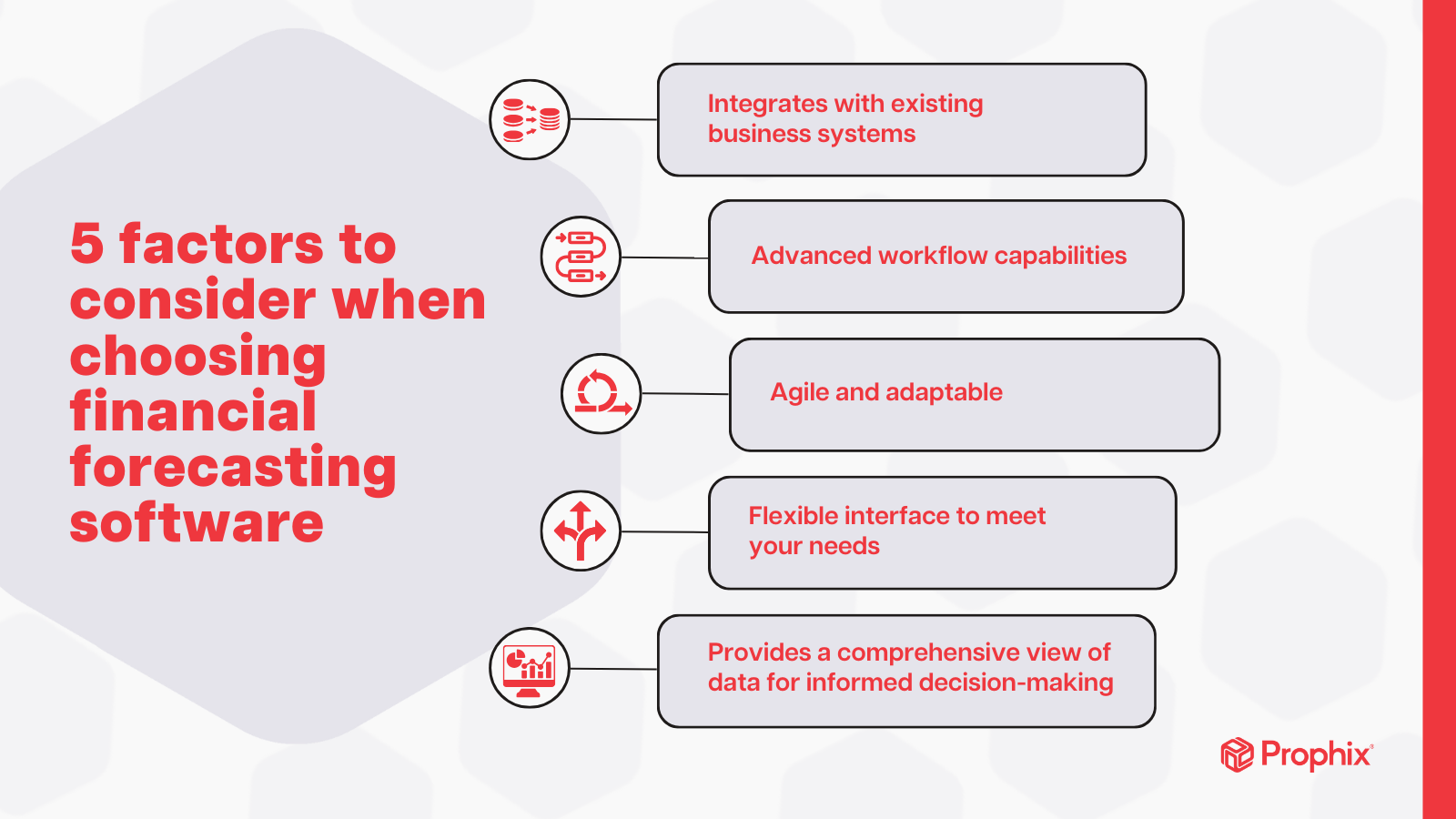

How to choose the best financial forecasting software for your team

When choosing the best financial forecasting software for your team, here are a five key factors to consider:

- Integrated solution: Choose software that seamlessly integrates with your existing business systems. This eliminates the need for manual data entry, reduces errors, and makes all your actual, planned, and forecasted data accessible in one place.

- Enhanced collaboration: Look for advanced workflow capabilities that streamline forecasting by tracking inputs, changes, and approvals.

- Agility and adaptability: Your financial forecasting software should allow you to quickly adapt for fluctuating interest rates, currency rates, production levels, and payment terms.

- Flexibility and comfort: Financial forecasting software should give you the freedom to contribute to forecasts, approve plans, and manipulate numbers using the interface you are most comfortable with. Whether you prefer a feature-rich web interface or the convenience of Excel, the right tool will let you forecast with speed and accuracy.

- Informed decision-making: Ultimately, the goal is to make better and more timely business decisions. Good forecasting software offers a comprehensive view into your financial data, leverages automation and AI for collaboration, and provides the agility required to transform the frequency and accuracy of your forecasting.

By considering these factors, you can choose financial forecasting software that not only meets your current needs but also scales with you, keeping you ahead of the competition.

What are the 4 major financial forecasting methods?

There are four major financial forecasting methods. Let’s look at each in more detail.

Straight-line

This is the simplest form of forecasting that assumes business conditions will continue as they are. It projects future values by extending a line through past data points, assuming a steady rate of growth. Though simplistic, it can be useful for stable environments.

Moving average

Moving average forecasting smooths out short-term fluctuations and highlights longer-term trends or cycles. By averaging a certain number of periods, it provides a 'moving' average that adapts to new data as it comes in, making it a good choice for identifying patterns over time.

Simple linear regression

Simple linear regression predicts one variable based on its relationship with another. It involves creating a best-fit line that minimizes the distance between the line and the data points. It's ideal for forecasting when there's a clear, linear relationship between two variables.

Multiple linear regression

Multiple linear regression extends the simple linear regression by considering multiple influencing variables. It uses more complex calculations to find the best-fit line but offers a more accurate forecast when multiple factors influence the outcome.

Each method has its strengths and weaknesses, so the choice depends on your business's specific needs and the data you're working with.

How do you do financial forecasting?

Financial forecasting is a step-by-step process:

- Identify the period: Determine the time frame you want to forecast. This could range from quarterly, annually, to several years ahead.

- Gather historical data: Collect past financial data, including revenue, expenses, and cash flow, which will serve as the basis for your predictions.

- Analyze trends: Study the historical data to identify patterns, trends, and growth rates. Use these insights to inform your forecasts.

- Make assumptions: Based on your analysis, make educated assumptions about future conditions, such as market growth, inflation rates, and changes in costs.

- Create projections: Use forecasting methods like straight-line, moving average, or regression analysis to create projections based on your assumptions.

- Review and adjust: Regularly review your forecasts and adjust them as necessary to account for changes in business conditions or performance.

FAQs about financial forecasting software

Let’s answer some of the most frequently asked questions about financial forecasting software.

What is the difference between financial forecasting vs. financial planning vs. business budgeting?

Financial forecasting, financial planning, and business budgeting are all part of managing a company’s finances.

- Financial forecasting involves predicting future revenues and expenses based on historical data and trends, serving as an estimation of what to expect.

- Financial planning involves strategizing how to allocate resources to meet the company's goals and objectives.

- Business budgeting is the process of assigning specific monetary amounts to different departments or projects within a certain period, providing a detailed plan of where funds will be spent.

What is sales forecasting?

Sales forecasts estimate future sales revenue, based on historical sales data, market analysis, and industry trends. It enables businesses to make informed decisions about managing inventory, budgeting, and setting profit goals.

How does financial forecasting relate to the demand planning process?

Financial forecasting and demand planning are closely intertwined processes. Demand planning predicts the products and quantities that customers will buy, which informs financial forecasting by providing expected revenue figures. Accurate demand planning is key to creating reliable financial forecasts, helping you better manage your resources and strategize for future growth.

Is financial forecasting related to headcount planning?

Financial forecasting is related to headcount planning. Financial forecasting provides an estimate of future revenues and expenses, which includes staffing costs. Financial forecasting directly influences headcount planning as businesses must align their hiring strategies with their projected growth.

What are some common pitfalls of financial forecasting?

Common pitfalls of financial forecasting include relying too heavily on historical data without considering market changes, not accounting for unexpected expenses, and failing to regularly update forecasts.These mistakes can lead to inaccurate projections, which may result in poor decision-making.

Conclusion: Choose the best financial forecasting software

Financial forecasting software is a game-changer for businesses of all sizes, enabling high-impact financial planning and analysis.

Whether you're a startup looking to maximize your funding or an established enterprise aiming to optimize operations, financial forecasting software is your strategic partner for sustainable growth in 2024. Make the most of these 22 best financial forecasting software options to steer your business towards success.