Download Analyst Report

GLOBAL TAX COMPLIANCE SOFTWARE

Simplify global tax compliance with automated processes and centralized data management

Why choose Prophix One™ for global tax compliance

Centralized data modeling and adaptive calculations

Model all your tax data, entities, and scenarios with global tax compliance software. Prophix gives you the calculation engine to handle global minimum tax requirements—without spreadsheets or disconnected systems.

Automated tax reporting and disclosures

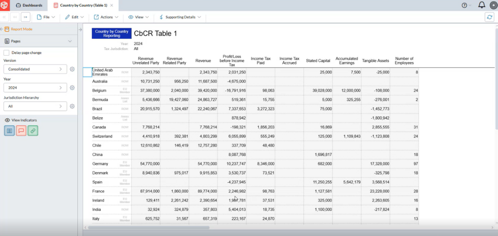

Generate OECD-compliant Pillar Two and CbC (Country-by-Country) reports and disclosures on demand. Ensure accuracy and consistency across all submissions to regulators and internal stakeholders.

Secure audit trail and documentation management

Capture every change, assumption, and decision in a fully traceable audit trail. Centrally store supporting documents and explanations for easy access during reviews or regulatory checks.

Collaborative workflows and controls

Reduce risk and manual effort with structured workflows for data input, review, and approvals. Align tax, finance, and compliance teams across geographies with full visibility into each step.

End-to-end tax reporting

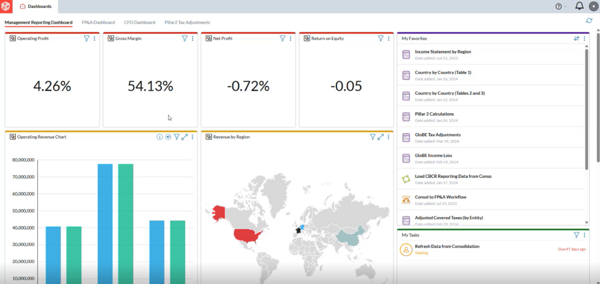

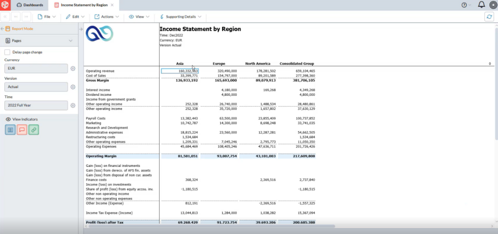

Tax reporting in Prophix One provides end-to-end visibility and control over your global tax compliance process, including Pillar 2 and Country-by-Country (CbCR) reporting. From standardized data collection to automated calculations and disclosure generation, Prophix One delivers a unified solution for managing complex, multi-entity requirements. Pre-built templates ensure consistency across jurisdictions, while configurable reports and dashboards help you track entity-level exposures, monitor compliance tasks, and surface key insights.

Seamless integration with Prophix One Financial Consolidation

Prophix One ensures seamless integration between your global tax reporting and your financial consolidations, creating a single source of truth for tax and financial data. Easily connect to HR, Legal, Finance, and other critical systems to bring in the data you need—accurately and in real time. Pull actuals, forecasts, and entity structures directly into your tax reporting model, and enrich it with external data from flat files for a full picture of your reporting.

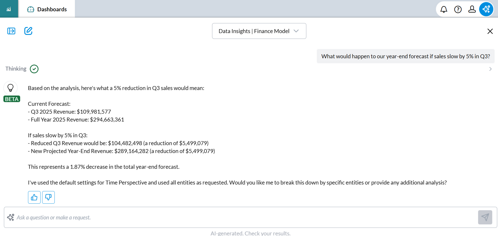

Scenario modeling and tax planning intelligence

Prophix One enables you to model global tax scenarios and plan with confidence using AI-powered insights and automation. Instantly assess the impact of policy changes, shifting entity structures, or varying tax rates across jurisdictions. Use version-controlled templates to run what-if analyses, compare outcomes, and align cross-functional planning with evolving tax strategies.

Driving financial reporting accuracy and data confidence

Finance as we know it is changing

What does the next generation budgeting and planning software look like for the Office of the CFO? Learn how to research, evaluate, and purchase budgeting and planning software. Check out the Ultimate Guide to Next-Gen Finance.

Made for finance leaders

Discover Prophix One and unlock your potential for success.

Reporting & Analytics

Increase data accuracy and reporting efficiency, affording you more time for valuable analysis.

Financial Consolidation

Streamline close windows by eliminating manual processes and automating recurring ones.

Automation & Workflow

Accelerate financial processes and improve collaboration.

AI Insights

Utilize AI to gain a deeper understanding of your business.

MS365 Add-In

Boost Excel’s financial modeling and planning capabilities and create insightful PowerPoint presentations.

Integrated Business Planning

Gain visibility across your business with integrated cross-functional business planning.

Account Reconciliation

Collaborative account reconciliation for smarter, faster financial close.

Frequently Asked Questions

What is Pillar 2 Tax Reporting?

Pillar 2 Tax Reporting is the process of calculating and disclosing a multinational organization's effective tax rate in alignment with the OECD’s global minimum tax rules. It ensures that large companies pay a minimum level of tax—typically 15%—in every jurisdiction where they operate.

How does Pillar 2 impact financial planning and consolidation?

Pillar 2 introduces new layers of complexity to entity-level reporting, requiring coordination between tax, finance, and consolidation teams. Accurate data, consistent calculations, and integration with financial planning are critical to assess tax regulation exposures and support compliance across jurisdictions.

How can Prophix One help with Pillar 2 Tax Reporting?

Prophix One automates data collection, calculation, and reporting for Pillar 2, reducing manual effort and risk. With built-in templates, audit-ready documentation, and seamless integration with financial consolidation, Prophix One helps you stay compliant—and plan strategically.