Download Analyst Report

Core Financial Close

Pre-Financial Close

Post- financial close

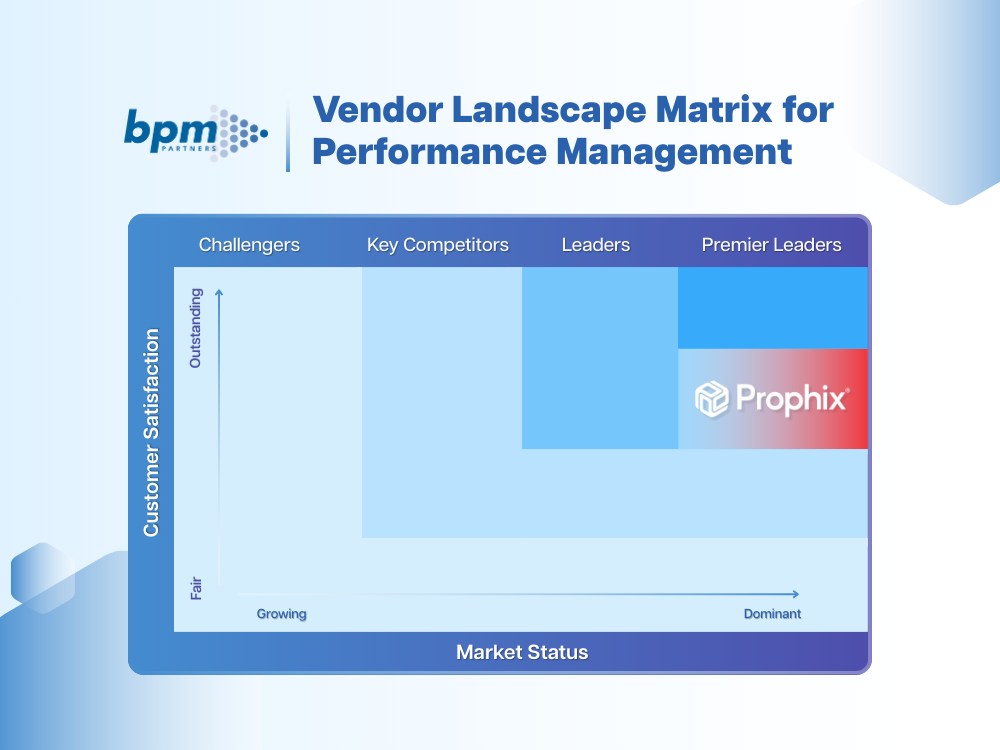

Download the Vendor Landscape Matrix Report

Mastering Financial Close: The Resource Center for Finance Leaders

But despite its importance, 60% of teams face delays due to manual processes and fragmented systems. Streamlining the close can cut time-to-close by up to 50%, allowing you to shift focus to analysis, forecasting, and driving business impact. So how can you overcome these delays and streamline processes for a faster, smarter close?

The Financial Close process can be broke down into three stages: The core, pre- and post- close. Let's explore how each stage is critical to a streamlined and accurate Financial Close process.

Core Financial Close

The ‘core' financial close is built on three essential pillars: account reconciliation, intercompany management, and financial consolidation. Each plays a vital role in turning raw financial data into reliable insights. Learn more about how each pillar strengthens your close process.

Featured Blog: Why a strong financial close is fundamental

Pre-Financial Close

What happens before the core financial close is equally important. Cash management and lease accounting are critical early steps in the financial close, helping ensure accuracy and compliance from the start.

Featured Blog: Pre- and post-close processes in finance—and why they matter

Pre-Financial Close

Cash Management

The key to effective liquidity planning to ensuring a more seamless close process.

Post- financial close

Disclosure management is the last step in the financial close, helping teams produce accurate, compliant reports while minimizing errors and review time. Read more to learn how it ensures transparency and confidence in your reporting.

Featured Blog: Financial disclosure management: A guide for finance in 2025