Download Analyst Report

What is an ESG report? ESG reporting for business in 2025

ESG encompasses a broader set of criteria, including corporate governance and social factors like labor practices, diversity, and community engagement.

March 13, 2025ESG can be traced back to the broader movements advocating for socially responsible investing (SRI) in the mid-20th century. During the 1960s and 1970s, investors began to align their financial decisions with ethical values.

By the 1990s, corporate governance gained prominence as major financial scandals, such as the collapse of Enron and WorldCom, highlighted the need for better transparency and accountability in businesses. This era laid the foundation for integrating environmental and social considerations into traditional financial analysis.

What is ESG?

The term ESG, short for Environmental, Social, and Governance, was first popularized in 2004 through a landmark report titled "Who Cares Wins," published by the United Nations Global Compact in collaboration with major financial institutions. This report argued that integrating environmental, social, and governance factors into investment decisions could lead to better long-term financial performance.

The 2010s saw exponential growth in ESG adoption as climate change became a global priority, and social justice issues gained momentum. Regulatory bodies, investors, and consumers pushed for greater corporate accountability, leading to the development of globally recognized ESG reporting frameworks such as the Global Reporting Initiative (GRI), the Sustainability Accounting Standards Board (SASB), and the Task Force on Climate-related Financial Disclosures (TCFD).

Today, ESG is a critical lens through which businesses are evaluated. The global demand for transparency, combined with growing evidence linking ESG performance to financial success, has transformed ESG from a niche concern into a central element of corporate strategy and decision-making.

What’s the difference between ESG and sustainability?

While ESG and sustainability are closely related, they are not the same. Sustainability focuses on meeting the needs of the present without compromising the future, often emphasizing environmental and long-term ecological goals. ESG encompasses a broader set of criteria, including corporate governance and social factors like labor practices, diversity, and community engagement. Think of sustainability as the "what" and ESG as the "how" when it comes to achieving ethical and sustainable business practices.

What’s the difference between ESG and CSR?

Corporate Social Responsibility (CSR) and ESG are similar in intent but differ in execution and focus. CSR is a company’s voluntary initiatives to improve societal well-being, often through philanthropy and community projects. ESG is more comprehensive and data-driven, involving measurable criteria and performance indicators that align with stakeholder demands and regulatory expectations. ESG reporting holds companies accountable through standardized frameworks, while CSR is often more informal.

What is an ESG report?

An ESG report is a document that outlines a company’s performance in the three ESG categories—Environmental, Social, and Governance. It provides transparency for stakeholders, such as investors, employees, customers, and regulators, by highlighting the company’s efforts, achievements, challenges, and areas for improvement in these critical domains.

The primary goal of an ESG report is to showcase a company’s commitment to sustainable and ethical practices, allowing stakeholders to assess its long-term viability and values. By providing measurable data and qualitative narratives, ESG reports help build trust, attract investment, and comply with regulatory requirements. Moreover, they serve as a roadmap for companies to align their operations with global sustainability goals and stakeholder expectations.

An ESG report typically includes performance metrics, narratives, and forward-looking goals across the three core categories:

Environmental criteria

- Energy use: Renewable energy adoption, carbon emissions, and efficiency.

- Waste management: Recycling programs and waste reduction.

- Climate change initiatives: Policies for reducing environmental impact and climate risk.

- Natural resource conservation: Water use and biodiversity protection.

Social criteria

- Employee welfare: Workplace safety, diversity, and inclusion initiatives.

- Community impact: Charitable contributions and community development.

- Human rights: Ethical labor practices and supply chain accountability.

- Customer satisfaction: Transparent communication and responsible marketing.

Governance criteria

- Board diversity: Representation of various demographics and perspectives.

- Ethical leadership: Transparent executive compensation and policies.

- Compliance: Adherence to regulations and codes of conduct.

- Stakeholder engagement: Mechanisms for shareholder input and accountability.

How should companies report non-financial information?

To report non-financial information effectively, companies can use globally recognized frameworks like the Global Reporting Initiative (GRI). The GRI provides detailed guidelines that enable organizations to create consistent, transparent, and comprehensive ESG reports. It emphasizes materiality, helping businesses identify the most significant topics for their stakeholders while ensuring alignment with both regulatory requirements and global standards. The GRI’s sector-specific standards make it adaptable to various industries, enhancing the relevance and comparability of disclosures.

Other popular frameworks and standards include:

- Sustainability Accounting Standards Board (SASB): SASB focuses on industry-specific ESG factors that are financially material, offering detailed metrics that help investors understand the impact of sustainability on financial performance.

- Task Force on Climate-related Financial Disclosures (TCFD): The TCFD provides a framework for climate-related risk reporting, emphasizing governance, strategy, risk management, and metrics. It’s particularly relevant for companies addressing climate change and transitioning to a low-carbon economy.

- The Carbon Disclosure Project: CDP was established in 2000, building on the GRI. In comparison, CDP reporting is tailored to investors, requiring the aggregation of information on environmental impacts such as statistics on emissions and measures to mitigate climate change and minimize environmental impact of corporations.

By leveraging these frameworks, companies can effectively communicate their ESG initiatives, foster stakeholder trust, and ensure compliance with evolving global regulations.

What are ESG scores and regulations?

Who assigns ESG scores?

ESG scores are typically assigned by third-party rating agencies such as MSCI, Sustainalytics, and S&P Global. These agencies play a crucial role in evaluating a company’s Environmental, Social, and Governance (ESG) performance by using proprietary methodologies tailored to assess a wide range of factors.

- MSCI: MSCI assigns ESG scores based on how well a company manages risks and opportunities related to environmental, social, and governance issues. Their ratings are widely used by investors to make informed decisions.

- Sustainalytics: This agency focuses on identifying material ESG risks and evaluates a company’s ability to manage those risks effectively. They offer ESG Risk Ratings, categorizing companies based on exposure and management.

- S&P Global: Known for its credit ratings, S&P Global also provides ESG evaluations. Their scoring methodology examines ESG factors that could impact financial performance, aligning with investor interests.

Who creates ESG regulations?

Governments and regulatory bodies create ESG regulations. In the EU, for example, the European Commission leads initiatives like the Corporate Sustainability Reporting Directive (CSRD). In the U.S., the SEC has proposed rules for climate-related disclosures. Globally, the International Sustainability Standards Board (ISSB) plays a crucial role in shaping reporting standards.

Why businesses need to be doing ESG reporting

There’s a demand for trustworthy ESG data

Investors, consumers, and regulatory bodies increasingly demand reliable ESG data to assess company performance. Transparent ESG reporting fosters trust and enhances corporate credibility.

Strong ESG initiatives and strategies create better business outcomes

Studies show that companies with robust ESG practices often experience:

- Improved risk management

- Higher employee satisfaction

- Greater customer loyalty

- Long-term profitability

How ESG reports differ by region

Canada

- Mandatory? No, but moving toward mandatory disclosures for large companies.

- Governing body: Canadian Securities Administrators (CSA).

- Preferred framework(s): TCFD and SASB.

USA

- Mandatory? Partially, with climate disclosure rules proposed by the SEC.

- Governing body: Securities and Exchange Commission (SEC).

- Preferred framework(s): TCFD and SASB.

UK

- Mandatory? Yes, for large businesses under the UK Companies Act.

- Governing body: Financial Reporting Council (FRC).

- Preferred framework(s): TCFD and GRI.

EU

- Mandatory? Yes, under the CSRD.

- Governing body: European Commission.

- Preferred framework(s): CSRD and GRI.

Asia

- Mandatory? Varies by country (e.g., mandatory in Hong Kong and Singapore).

- Governing body: Local regulators like the HKEX and MAS.

- Preferred framework(s): GRI and TCFD.

How businesses can start with ESG reporting

1. Identify your stakeholders—who is the ESG report for?

Begin by determining the key stakeholders for your ESG report,, such as investors, customers, employees, and regulators. Understanding your stakeholders’ interests and priorities is essential for shaping your reporting strategy. For instance, investors may prioritize financial materiality, while employees might focus on workplace diversity and ethics.

2. Research leading ESG reports

Study top-tier ESG reports and ESG reporting standards within and outside your industry to benchmark best practices. Analyzing these reports can provide valuable insights into effective data presentation, common metrics, and narrative strategies. Look for reports that align with frameworks like GRI or TCFD to ensure your approach is relevant and credible.

3. Build your ESG reporting plan

Develop a comprehensive plan that outlines:

- Objectives: Define what you aim to achieve, such as compliance, investor engagement, or reputational enhancement.

- Data collection: Identify data sources, assign responsibilities, and establish processes for accurate data gathering.

- Key metrics: Select measurable indicators relevant to your industry and stakeholders.

- Framework alignment: Use established ESG reporting standards like GRI or TCFD to guide your efforts.

- Timeline: Set clear milestones and deadlines for completing your report.

A well-structured plan ensures consistency, transparency, and alignment with global best practices.

How to write an ESG report

Creating an ESG report requires a structured approach to ensure clarity, accuracy, and relevance. Here’s an expanded framework to guide the process.

Sample ESG reporting framework

Step 1: Define material issues

The first step in creating an ESG report is identifying the ESG factors most relevant to your business and stakeholders. Material issues will vary depending on your industry, geography, and company-specific risks. For example, a manufacturing company may prioritize energy efficiency and waste management, while a tech company may focus on data security and diversity initiatives. Conduct stakeholder interviews, materiality assessments, and industry benchmarking to pinpoint the key issues to address.

Step 2: Collect data

Gathering data is critical to substantiate your ESG claims. This process involves:

- Collecting quantitative data, such as carbon emissions, energy use, workforce demographics, and supply chain metrics.

- Compiling qualitative data, such as case studies, policies, and testimonials that demonstrate your initiatives.

Data should be verified for accuracy and relevance, using tools like ESG software or engaging third-party assurance providers.

Step 3: Align with a framework

Structure your ESG report according to a recognized reporting standard. Frameworks like GRI, SASB, and TCFD offer detailed guidance for organizing your report and ensuring it meets stakeholder and regulatory expectations. This step also involves integrating your ESG goals with broader business objectives, showing how sustainability contributes to long-term value creation.

Step 4: Develop a clear narrative

Use the data to craft a cohesive narrative. Highlight your achievements, acknowledge challenges, and outline future goals. Include graphics, charts, and infographics to make the report more accessible and engaging for readers.

Step 5: Review and publish

Before publishing, ensure the report undergoes rigorous review to confirm its accuracy and compliance with reporting standards. Once finalized, publish the report on your company’s website and distribute it to key stakeholders through relevant channels.

FedEx ESG report example

FedEx’s ESG reporting demonstrates their commitment to sustainability, social responsibility, and strong corporate governance. Their report is a comprehensive example of how global companies can align ESG initiatives with strategic business goals while addressing stakeholder expectations.

FedEx focuses on three primary areas—Environmental, Social, and Governance—to drive their ESG efforts:

Environmental goals: FedEx has set an ambitious target to achieve carbon-neutral operations by 2040. This includes electrifying their vehicle fleet, adopting sustainable fuels, implementing fuel conservation measures, modernizing their aircraft fleet, and investing in energy-efficient facilities.

Social commitments: The company prioritizes employee well-being, workplace safety, and the integration of Diversity, Equity, and Inclusion (DEI) into their business strategies. FedEx also aims to enhance health and safety measures and actively engage with the communities they serve.

Governance priorities: FedEx emphasizes strong governance practices by focusing on cybersecurity to protect data and systems, participating in public policy and advocacy efforts, and maintaining responsible oversight of their global supply chain.

FedEx’s ESG reporting aligns with globally recognized standards, ensuring transparency and comparability with peers. The frameworks they use include:

- Global Reporting Initiative (GRI): FedEx uses GRI to structure their disclosures around material ESG topics and provide detailed reporting.

- Sustainability Accounting Standards Board (SASB): The SASB framework allows FedEx to focus on industry-specific ESG metrics that are financially material to stakeholders.

- Task Force on Climate-Related Financial Disclosures (TCFD): FedEx incorporates TCFD guidelines to address climate-related risks and opportunities, ensuring their ESG strategy is robust and future-ready.

FedEx’s ESG report is an excellent example of how to balance ambitious environmental goals, impactful social initiatives, and rigorous governance practices. By using multiple frameworks such as GRI, SASB, and TCFD, FedEx provides a clear, transparent, and comprehensive look at their ESG performance. Their report not only highlights achievements but also sets a roadmap for future improvements, offering valuable insights for other companies aiming to enhance their ESG efforts.

FAQs about ESG reports

Is ESG a score or a rating?

ESG can refer to both scores (numerical values) and ratings (graded assessments) provided by agencies like MSCI or Sustainalytics.

What is the role of XBRL in ESG reporting?

XBRL (eXtensible Business Reporting Language) standardizes digital financial reporting, making ESG data easier to analyze and compare.

What is the main purpose of ESG?

The main purpose of ESG is to provide transparency on a company’s sustainability and ethical practices, enabling better decision-making by stakeholders.

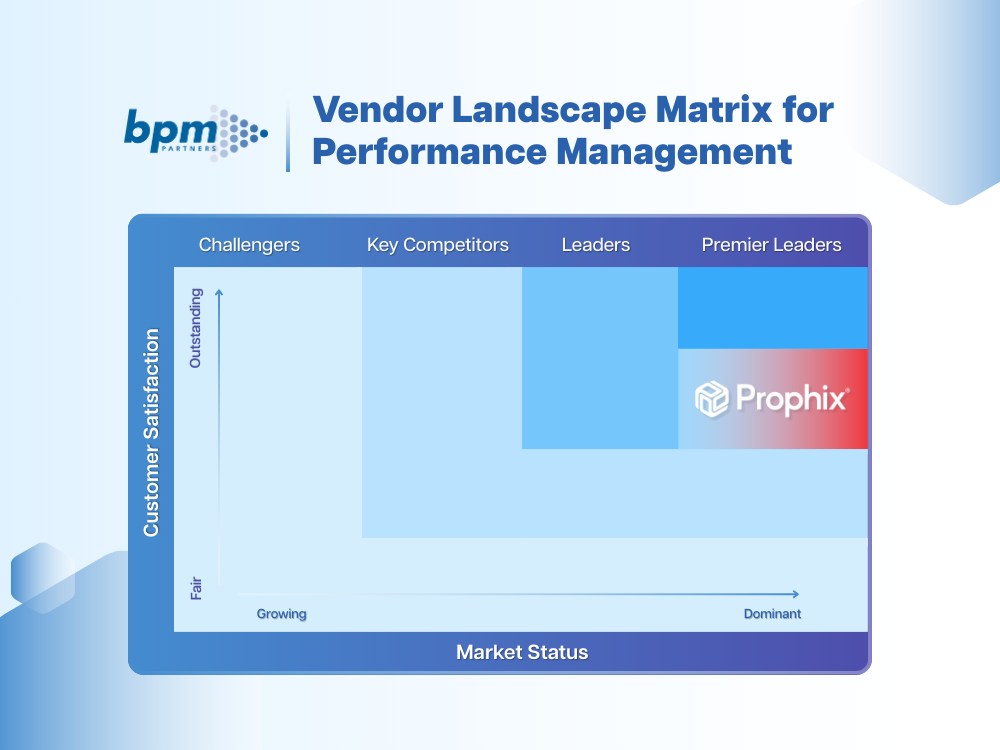

Conclusion: Create an ESG report with Prophix

Creating a robust ESG report doesn’t have to be daunting. Prophix’s ESG reporting software standardizes the reporting process, ensuring accuracy and compliance with leading standards. Start building your ESG strategy today and make a positive impact on your business and the world.

Learn more about ESG reporting software.

Insights for next-gen finance leaders

Stay ahead with actionable finance strategies, tips, news, and trends.