Download Analyst Report

The Ultimate FP&A Platform Buyer's Guide for 2026

Are you looking for a better way to manage your budget or automate your tasks?

September 25, 2024Are you looking for a better way to manage your budget or automate your tedious tasks? Do you feel like you’ve pushed the limits of spreadsheets and are ready to move on?

These are signs that it’s time to invest in an FP&A platform. FP&A platforms offer a comprehensive solution to manage all your finance activities. An FP&A platform can automate repetitive or complex tasks, streamline your operations, and boost your productivity.

FP&A platforms can include solutions for consolidations, intercompany management, account reconciliation, and the reason you're here, financial planning & analysis.

So, how do you choose the right FP&A platform that will drive business performance?

A well-informed decision when selecting an FP&A platform vendor can lead to improved budgeting, strategic planning, and overall financial health.

In this FP&A Platform Buyer’s Guide, we’ll cover:

At the end of this guide, you’ll be armed with the knowledge you need to choose an FP&A platform that aligns with your specific needs and business goals.

What to look for when buying an FP&A platform

FP&A platforms are for CFOs, finance leaders, and decision-makers to manage reporting, budgeting, forecasting, and planning, and track the overall financial health of your business.

With an FP&A platform, you can:

- Streamline your budget management

- Automate repetitive processes

- Integrate your financial data in one platform

- Access real-time data points from customizable, interactive dashboards

- Create comprehensive, insightful forecasts

- Conduct complex data analysis

- Adjust to changing conditions in real-time

FP&A software is a critical component of financial performance management.

Align with your business needs

When buying FP&A software, it’s important you consider the needs of your team and your business. What processes are you looking to streamline? What improvements are you looking to make?

It’s also important to understand if there are specific time-based hurdles that will impact your buying decision. Do you need to allocate your budget to a specific quarter? Is there a monthly or quarterly Board or executive meeting that you need approval from to move ahead with the buying process?

Have a clear set of goals, outcomes, and a timeline laid out before you start your research to help you narrow down your list of vendors and ensure you’re engaging with companies who will meet your needs.

How to research FP&A platform vendors

Now that you’re aligned on your business needs, it’s time to start researching FP&A platform vendors.

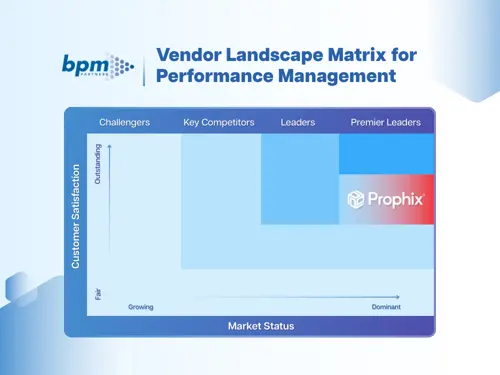

The FP&A software market is a diverse and competitive landscape with multiple vendors offering a wide range of solutions, each with its own set of pros and cons. But the number of options is a testament to the growing demand for budgeting and planning software.

On the bright side, the abundance of choice allows organizations to evaluate and choose a preferred vendor based on their individual needs and preferences.

Start by searching for FP&A platform vendors. We’ve done some of that research for you with our best business budgeting software list.

Look at the target audience for the FP&A software (are you a small business? You can immediately eliminate software targeted towards large enterprises!), the features offered, pros and cons, and most importantly, pricing. If you have a small budget and the FP&A software has a big price tag, it makes it easy to eliminate options.

Simplify and transform your finance processes with Prophix’s FP&A software.

9 steps to get stakeholder buy-in

Often, business leaders are so focused on the next issue that it’s difficult to find time to solve the root cause. Finance teams can champion the case for technology investment

Here are 9 steps you can use as a roadmap to get stakeholder buy-in for FP&A software and build a business case:

- Identify who your stakeholders are and engage them from the start.

- Connect the challenges you’re facing with senior management’s priorities.

- Identify your biggest problem and outline the benefits of solving it and how an FP&A platform can support this.

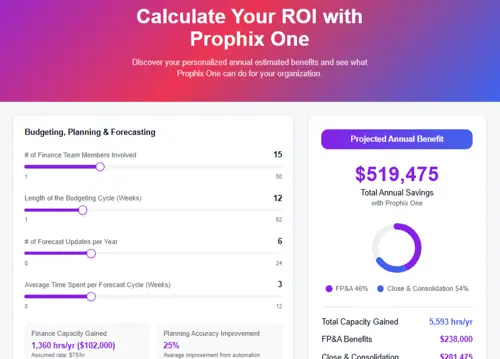

- Calculate your return on investment (ROI) — what is the risk of maintaining the status quo? Compare that with the expected outcomes and benefits of an FP&A platform.

- Define your budget. According to a Nucleus study, FP&A software returns $3.18 for every dollar spent.

- Research FP&A platform customer success stories to understand ROI and the impact on companies of comparable size.

- Using all the above, present your business case to your leadership team; show how an FP&A platform will solve business problems and create value.

- Develop a plan for the roll-out of your FP&A platform so everyone can anticipate timelines and desired outcomes.

- Continue to emphasize the value of an FP&A platform to your team and your organization. An agile and innovative finance function has the power to transform your organization.

Understand how FP&A platforms can support your business goals

You’ve got stakeholder buy-in, and you’ve done preliminary research, now it’s time to dive into the nitty-gritty part of your research. When purchasing an FP&A platform, you should consider:

- Features and functionality

- Security

- Customer support

- Implementation

- Cost (Learn more about FP&A pricing)

FP&A features and functionality

When you’re evaluating FP&A platform vendors, there are five feature and functionality areas to focus on:

- Budgeting and forecasting

- Reporting and analytics

- Data integrity and integration

- Collaboration

- Data accuracy

Let’s look at each area in more detail.

1. Budgeting and forecasting

FP&A platforms empower organizations to improve their budgeting, planning, and forecasting processes with a comprehensive suite of features. Automated forecasts help finance teams plan for and create agile strategies that move the business forward. Budgeting workflows and role-based access can further streamline your budgeting process by promoting accountability and transparency.

These capabilities come together into several positive business outcomes:

- Improved cost-effectiveness

- Increased data integrity

- Organizational transparency

- Enhanced finance metrics like profit margin percentage, return on assets, and operating margin percentage

These outcomes position your business for greater financial success and growth.

2. Reporting and analytics

FP&A platforms offer powerful reporting, analysis, and data visualization tools. Customizable reports and dynamic dashboards offer an intuitive and comprehensive view of financial data. You can quickly drill into data to understand variances, trends, or anomalies. Reporting can be streamlined with automation, while enhancing the cadence and accuracy of your reports.

Automate the creation and distribution of reports.

3. Data integrity and integration

FP&A platforms with robust data integrity and seamless integration with your ERP, CRM or other systems can improve the accuracy and reliability of your financial data, empowering you to make informed decisions and mitigate the risk of costly errors or misjudgments.

4. Collaboration

FP&A platforms facilitate cross-functional collaboration. In a world of remote work and geographically dispersed teams, a centralized FP&A platform ensures all your stakeholders have access to the most up-to-date financial data in a single source of truth.

5. Data accuracy

Spreadsheets and manual data input run the risk of errors. FP&A platforms enable you to automate calculations, allocations, and processes without the fear of broken formulas or circular references.

Security

Security and compliance are key to evaluate when you’re choosing any software vendor. Peace of mind regarding the security and protection of your data is essential. Here’s what to look for when comparing and evaluating FP&A software vendors.

- Frequency of audits: Cloud SaaS providers have the option to perform security audits yearly or more frequently.

- Compliance standards: There are multiple reports that prove an organization is in good standing, namely SOC 1 and SOC 2 compliance. It’s vital that both Type I and Type II reports are complete.

- Security frameworks: To claim they are secure; an organization must adhere to a framework that dictates how they should manage their data. This framework is built around an Information Security Management System (ISMS).

- Cloud infrastructure provider: There are a handful of well-known providers of cloud infrastructure that underpin the technology of cloud software vendors. Common providers include AWS, Azure, and Google.

Customer Support

When you invest in a FP&A platform, you’re creating a partnership with the vendor. Whether it’s the initial implementation or day-to-day support, it’s imperative to understand the support offering—and reputation—of the organization. Here’s what you should anticipate:

- Access to product specialists: A team of experts who provide you with valuable insights, design assistance, personalized product guidance, tailored training, and assistance with data integration.

- A personal advocate: A devoted Customer Success Manager is your advocate, collaborating with you to optimize the end-user experience and maximize the return on your FP&A platform investment.

- Learning resources: Access to continued learning offers you resources for skill-building, so you can continually elevate your experience.

Implementation

The implementation of a FP&A platform is a multifaceted process, which aims to ensure the successful integration and usage of the software at your organization. Implementation timelines can vary. To get a good understanding of how long it will take to implement, you can cross-reference what you hear from other users or connections in your network who have implemented the same or similar FP&A software.

Essential components of FP&A platform implementation include:

- Data integration – collecting and integrating data from your sources.

- Building out data models – models are the structures that organize and store your data for multidimensional analysis.

- Workflow design – establishing automated workflows is critical to streamlining your FP&A processes.

- Training – onboarding your team and other end-users to leverage platform capabilities so everyone can enjoy the benefits of FP&A software with speed and agility.

Cost

Let’s talk about cost. Arguably the most important consideration when looking to buy a FP&A platform.

The cost of an FP&A platform varies based on specific factors and requirements, including the software vendor, the features and capabilities of the platform, the size of your organization, and your specific needs.

Here are 5 common pricing models for FP&A software:

- Subscription-based pricing

This is the most common pricing model for FP&A software platforms. This means you pay a recurring fee, typically monthly or annually, to use the product. The cost of the subscription varies depending on the number of users, level of functionality, and the size of your organization.

- Tiered pricing

Some software vendors offer different pricing tiers based on the degree of features and functionality you need. You can choose a tier that aligns with your requirements and budget. Higher tiers often come with more advanced features and support.

- Per-user pricing

Another pricing model, although less common for FP&A platforms, is based on the number of users. Therefore, the more users you have, the higher the cost. This model can be cost-effective for small to mid-sized businesses if you have a smaller number of users.

- Usage-based pricing

Usage-based pricing charges based on the volume of data or transactions you process through the FP&A platform. This model is common for software that is used for financial analysis, reporting, and data consolidation.

- Custom pricing

For larger organizations with specific or complex needs, custom pricing models are available.Custom pricing may require negotiation with the software vendor to determine a pricing structure that meets your requirements.

Create a shortlist of vendors

Now that you’re armed with cross-functional alignment and stakeholder buy-in, you’ve done your initial scope of research, and you understand what you need from an FP&A platform to meet your goals and drive the business forward—it's time to create a shortlist of vendors.

Your shortlist can be the top 3-5 vendors that you want to have further discussions with. Look at the vendors who have customers in the same industry as you. It’s likely that the vendor will understand your specific needs and experience.

Additionally, review customer case studies and third-party review sites like TrustRadius or G2 for more information.

Ask questions and contact customer references

Part of the FP&A platform selection process is having in-depth conversations not only with the vendor, but with their customers too.

It’s important to ask FP&A platform vendors about their:

- Industry expertise: Choose a vendor with a long tenure not only in the FP&A space, but in your industry too.

- Security: What is the security protocol? Is there regulatory compliance with security controls?

- Implementation: Is it a self-serve approach or a consultant-led approach?

- Scalability: While you might only need FP&A software for financial planning and analysis right now, prioritize a vendor that can grow with your business to accommodate budgeting and planning, reporting and analysis, consolidations, or intercompany management.

- Features and functionality: Does the platform offer automation for data integration and workflows, audit logs, built-in data analysis, ad-hoc analysis, and more?

When talking to customer references, make sure you pick customers that are like you in industry, size, and customer base. Use this opportunity to ask questions that relate to your processes, focus on facts and examples (versus opinions), and talk to more than one user at the company, if possible.

Take the same approach when you’re speaking with the software vendor. Ask questions that relate to your processes and how they can solve the problems specific to your business.

Most importantly, don’t evaluate the information they’re providing you in-the-moment. Instead, take detailed notes or record the call so you can go back after the fact, evaluate the answers, and move forward with a decision.

Pick your preferred FP&A platform vendor

You’ve made the reference calls. You’ve asked the questions. You’ve got an inside-look at the platform and how it works. Now it’s time to pick your preferred vendor.

Pricing conversations have happened. You understand features and functionalities. You’ve considered the length of your contract, the number of users, the number and complexity of your data integration, and the level of service they provide.

Select your preferred FP&A platform vendor and move through to signing the contract.

Prepare for implementation

During your research phase, you’ve asked questions and understood how your chosen FP&A platform vendor approaches implementation.

Prepare your team for implementation. If it’s a self-led implementation approach, make sure other tasks and projects are prioritized around the implementation so you can see quick time-to-value on your investment. The sooner you can complete your implementation, the sooner you can be up and running with speed, efficiency, and agility.

It’s not a one-size-fits-all approach to buying an FP&A platform

The journey to select the right FP&A platform vendor for your business is an essential step in leveling-up your organization’s finance operations. Whether you’re aiming to streamline your budget management, automate tedious tasks, and improve your overall financial performance, FP&A software offers the transformative power you need.

By following the steps outlined in this FP&A platform buyer’s guide, you’re on your way to a more informed and empowered decision-making process, setting you—and your organization—on a trajectory towards financial success and strategic growth.

Last updated November 2025

Find more helpful tips on choosing FP&A software in The Ultimate Financial Performance Platform Buyer’s Guide!