Download Analyst Report

Real customer reviews on cash flow software

Choosing the right cash flow software can be a daunting experience.

July 18, 2024Choosing the right cash flow software can be a daunting experience, but real customer reviews offer valuable insights.

They provide firsthand experiences and honest feedback, revealing cash flow software's true capabilities and potential pitfalls.

In this blog, we'll explore genuine reviews to help you make an informed decision, ensuring your investment in cash flow software delivers the results you need.

The challenge with buying cash flow software

If you’re in the market for cash flow software, it can be challenging to narrow down your options in a saturated market. Many tools do similar things, making it difficult to differentiate between them.

Some vendors specialize in one aspect of finance like budgeting or financial consolidation. Other vendors offer industry-specific solutions or customizable Excel add-ons. And some vendors offer the best-in-breed – a financial performance platform.

Financial performance platforms combine financial data and processes from across the organization with functionality that covers the full breadth of finance – from cash flow planning, to budgeting and planning, and financial consolidation and close.

As you navigate the cash flow software options, keep in mind that a financial performance platform is best equipped to not only improve your cash flow management but also extend these efficiencies to other finance processes within your organization.

When evaluating cash flow software, you should prioritize a solution that can support:

- Audit logs: Track and record changes made within the system to ensure transparency and improve accountability.

- Collaboration: Facilitates teamwork by allowing multiple users to work simultaneously on cash flow management tasks.

- Model-based data integration: Integrates various data sources into a cohesive model for more accurate cash flow analysis.

- Scalability: Ensures the software can grow with your company’s needs, handling increasing amounts of data and complexity.

- Personnel planning: Manage and forecast staff-related expenses and their impact on cash flow.

- AR and AP: Optimize accounts receivable (AR) and accounts payable (AP) processes to improve cash flow management.

- Trend analysis and reporting: Identify patterns and trends in your financial data to make more informed decisions.

- Seasonality: Account for seasonal variations in cash flow to better plan and allocate resources throughout the year.

Learn more about the 8 factors to consider when choosing a cash flow forecast solution in our blog.

Make the business case for cash flow software

The first step in making the business case for cash flow software is aligning the need for technology with your business goals. By exploring the processes you’d like to streamline, the improvements you’d like to make, and the budget and timeline you have to make this decision, you can demonstrate to your leadership team that this investment will deliver tangible value.

During this process, it’s also good to consider your long-term goals for cash flow management, so you can ensure the solution will scale with your business.

The second, and perhaps most important step, is getting stakeholder buy-in for cash flow software. You should identify all the relevant stakeholders and then begin aligning your ask for cash flow software with organizational priorities. This can include outlining your current challenges and showcasing how to solve them with cash flow software.

You can also calculate the potential return on investment (ROI) of cash flow software and compare this with expected outcomes to further demonstrate the value of a dedicated finance solution. After establishing your budget, you should research customer success stories to better understand ROI and the impact on companies of a comparable size.

Customer success stories are often what make the choice to invest in cash flow software feel more real for the stakeholders involved. Hearing from others in your role, or industry, can go a long way in demonstrating the value and potential of cash flow software.

With that said, let’s examine the role of cash flow software in FP&A, and then look at some real customer reviews.

The role of cash flow software in FP&A

Cash flow should not be overlooked in your financial planning & analysis processes (FP&A). In 2024, cash is not as available as it once was, but it’s still just as critical to the function and success of your company.

With excess cash available, your business can prioritize new investments, pursue growth opportunities, and scale operations. And often, effective investments and growth come down to how fast you can identify and act on these opportunities.

To do this efficiently, it’s essential that cash flow becomes an integral part of your FP&A processes. This means that your FP&A team should take ownership of the cash flow process by shifting their mindset from “profit” to “profit and cash.” Cash flow reporting should be shared widely, and FP&A teams should be involved in decisions around capital investments.

This is where cash flow software comes in. By automating cash flow tracking and reporting, you can easily identify trends and make better decisions faster. Effective cash flow management will also reduce short-term borrowing and prevent excess cash from sitting idle.

In addition, cash flow software can provide real-time insights and predictive analytics, enabling your team to proactively manage financial risks and capitalize on emerging opportunities.

Why organizations are implementing cash flow software

Depending on the size, scope, and complexity of your business, organizations will use cash flow software for a number of reasons. Let’s hear from a few users of cash flow software, and how it has benefited them:

“We love financial statement binders because we can tailor them to meet our needs. For example, we can input an income statement by state and/or district and consolidate it to include the whole company. We can do the same for balance sheets, cash flow statements, and trial balances. Prophix gives us a clear view of the company from all angles.” – TrustRadius reviewer

“I think if anyone is still spending time manipulating data in Excel in order to prepare financial statements, including statement of cash flows, they should do a cost benefit analysis. The system allows for set-and-forget formats including standard financial ratios/KPI's. Once the financial model is implemented you can move onto to job cost/WIP, equipment and personnel planning and modeling.” – TrustRadius reviewer

“I’ve been a CFO for 15 or 16 years. The one thing that keeps me up at night is cash flow, especially since we’re a private company and we develop in California, which is notorious for being heavily regulated. Prophix has helped me sleep better at night, as I have a better idea of cash flow because we start the budgeting process with pre-development and pre-construction activities, so we know what we’re going to spend when we get to the construction phase.” – Jonny Harmer, CFO, USA Properties

Top capabilities of cash flow software for FP&A

Cash flow software can empower your FP&A team with top capabilities to better prepare for the future. By prioritizing these capabilities in your software search, your business can significantly improve your cash flow planning, reporting, and analysis:

- Accurate cash flow planning – Finance professionals no longer need to waste time validating data. Instead, they can quickly create accurate cash flow forecasts, enabling better long-term strategic decision-making. This accuracy reduces the risk of financial surprises and enhances planning reliability.

- Detailed scenario planning – Cash flow software enables you to quickly respond to changing conditions. Businesses can evaluate the impact of various strategies on cash flow and mitigate risks effectively. This capability allows for flexible and responsive financial planning, adapting to market fluctuations and internal changes.

- Enhanced analysis – Intuitive access to cash flow data enables faster, more informed decisions, increasing team efficiency and improving analysis accuracy. Real-time insights and easy maneuverability reduce errors and provide more reliable information. Stakeholders gain confidence with up-to-date analysis, boosting trust from investors and other external relationships.

Conclusion: Make cash flow planning easier with Prophix One™

Customer reviews are a powerful tool in evaluating cash flow software, offering genuine insights and highlighting real-world performance. They help you identify strengths and weaknesses, ensuring you select a solution that meets your needs. By leveraging these firsthand experiences, you can make a more informed decision and invest confidently in the right cash flow software for your organization.

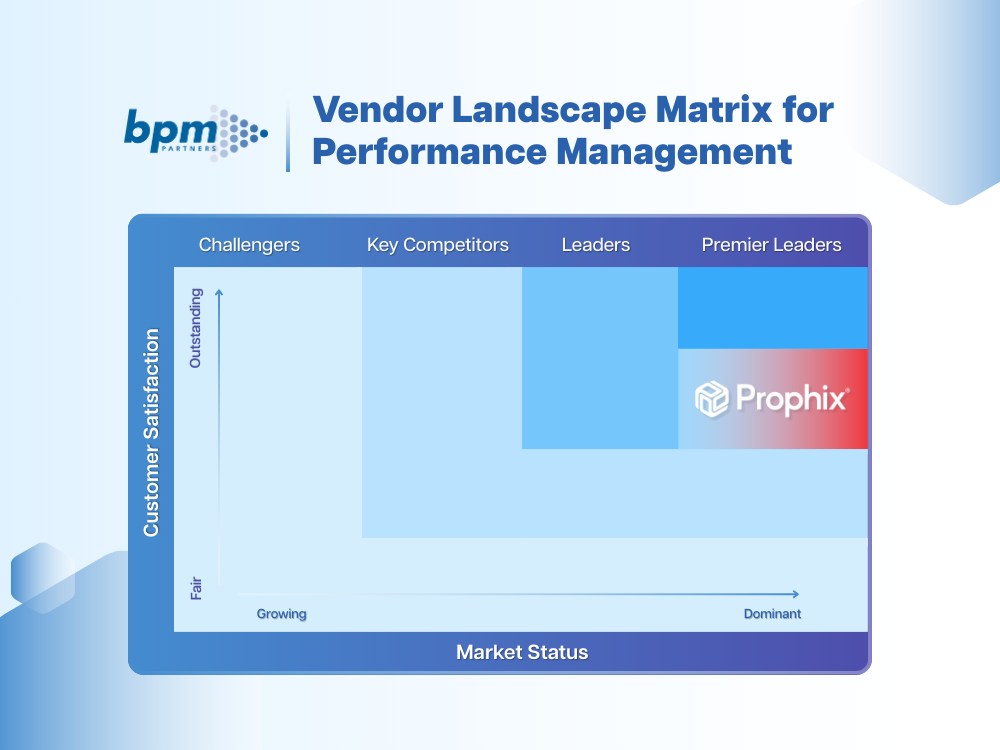

Prophix One is highly recommended by customers on TrustRadius, G2, and Gartner Peer Insights. Its all-in-one platform offers a clear picture of your company’s cash position, providing all the capabilities needed to confidently manage your cash flow.

Watch our 2-minute video to see how Prophix One can simplify your cash flow management.

Insights for next-gen finance leaders

Stay ahead with actionable finance strategies, tips, news, and trends.