Download Analyst Report

Colleges and Universities Need to Remove Manual Barriers for Effective Planning

Here is a story that may be familiar for many finance offices at Colleges and Universities. You are planning for the 2021/2022 academic year. You are planning 6 months in advance, partially because t

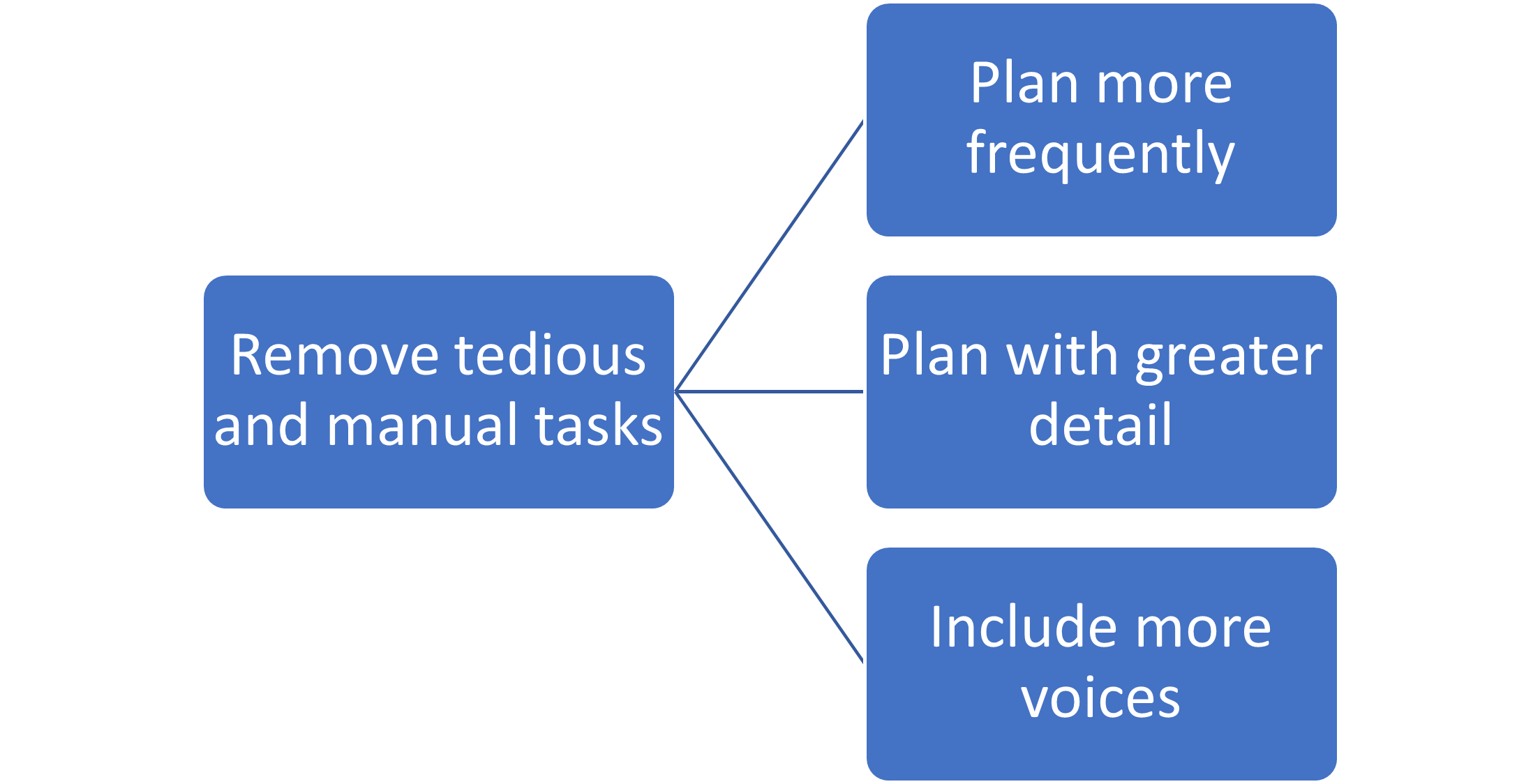

February 17, 2021Remove tedious, manual tasks

Removing the manual points of friction is the key to opening new possibilities and improving the planning process. Every manual step is time stolen from finance leaders. Every manual step is lengthening the timelines it takes to plan. Every manual step is making it more complex to incorporate good feedback from around the University or college. Every manual step is introducing the possibility of errors. Fortunately, modern Corporate Performance Management software reduces friction at every point in the process:- You can set up data feeds that automatically load your trial balance, enrollment data, payroll information, curriculum information, or any other sources.

- You can set up standard input forms that you manage centrally and are reused for each of your programs or departments. Whether you have 20 departments or 200, you set up the format once and the unique combinations are created automatically.

- You can really take charge of your budgeting timelines and workflow. Rather than e-mailing files, your responsibility center owners log in to see the latest numbers and make inputs. You get live updates as the work is happening along with a dashboard to see who has submitted and who is still outstanding.

Plan more frequently

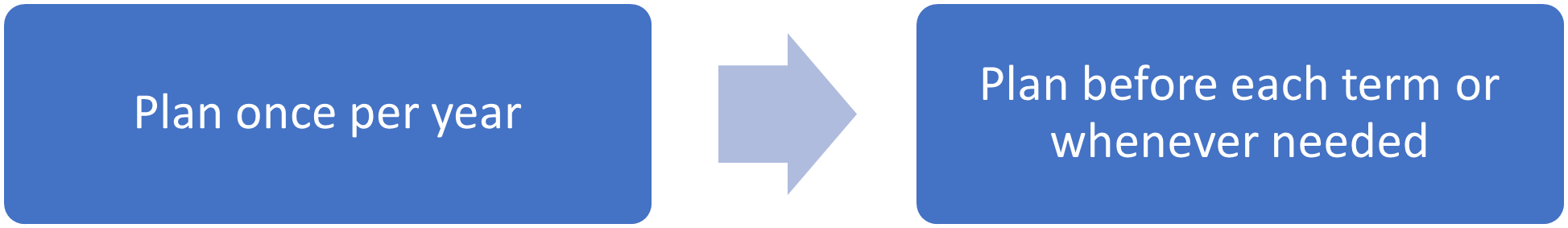

The annual budget is the standard for most organizations and for good reason. Universities and colleges have very structured academic terms that line up neatly with the calendar year, so it makes sense to plan against that. But at the same time, planning once per year is somewhat arbitrary. The situation can change more frequently than that.- With a recent uncertainty around the pandemic, what will enrollment look like between terms?

- If you implement new academic standards, what will that do to student attrition?

- How accurate are your expense forecasts and will you need to revise those at some point?

At a minimum, it is a good idea to run a short planning phase before each term to true-up assumptions and ensure the financials stay aligned with the central goals and mission of the university.

These new reforecasts need not be as detailed as the full budget process. If the original plan is strong and still highly relevant, you may not make any changes at all. You may only make some tweaks to enrollment or headcount. You may even keep this central within finance rather than a larger process that incorporates the rest of your responsibility centers.

The key is not to re-do an exhaustive budget process multiple times per year, but rather to be dynamic and ready to go through parts of the planning process whenever the need arises. Your software solution should be capable of being turned on or off whenever you need it, with minimal setup or configuration from you.

At a minimum, it is a good idea to run a short planning phase before each term to true-up assumptions and ensure the financials stay aligned with the central goals and mission of the university.

These new reforecasts need not be as detailed as the full budget process. If the original plan is strong and still highly relevant, you may not make any changes at all. You may only make some tweaks to enrollment or headcount. You may even keep this central within finance rather than a larger process that incorporates the rest of your responsibility centers.

The key is not to re-do an exhaustive budget process multiple times per year, but rather to be dynamic and ready to go through parts of the planning process whenever the need arises. Your software solution should be capable of being turned on or off whenever you need it, with minimal setup or configuration from you.

Plan with greater detail

Sometimes the summarized data coming from your general ledger is too broad to really help in the planning process. Take your dormitories and room & board. Within your financial statements, these revenue and expenses might be grouped into a handful of line-items. Planning at that same level of detail will hurt accuracy and will make it difficult to measure performance later. You might plan on-campus housing by first coming up with the logic for revenue. Housing revenue might equal the number of students’ times the average rate for rooms. Then you would split that by the number of housing facilities you have and for the different room types, with pricing different for single occupancy, double occupancy, shared accommodations, and so forth. From there you would layer on meal plans and then the various expenses for repairs & maintenance, security services, and utilities, and other components. Maybe some of these expenses are tied directly to your occupancy plan. In effect you can split off a separate housing model that loads historicals from your systems, uses a common set of calculations across your various room types and buildings, and is tied back to the full plan. What else?

What else?

- How much better will your plan be if you could model individual student cohorts with unique attrition and pricing assumptions for each?

- Who is the list of donors from last year and how much do we expect them to contribute this year?

- What are all the outstanding IT contracts for the college, when do they expire, and will they be renewed?

Include more voices in the process

A great financial plan incorporates insights from across the whole college. This may include recruiting & admissions, student services, advancement, alumni relations, human resources, all the academic units, and many others. With a CPM system in place, it becomes much easier to immerse these different stakeholders in the process. They can see all their historical data and it gets updated monthly. They can submit iterations of the plan and instantly communicate back and forth with you on key topics. They know exactly what is expected on them. They become accountable to their portion of the budget and put more effort and thought into their inputs. As the cumbersome mechanics of e-mailing Excel files back and forth go away, it becomes much easier to add new partners into the process. Whereas in the past you may have only interacted with the Vice chancellor of student affairs, now you are opening the process to the leaders of the career center, residential life, athletics, counseling, and student activities as well.

As the cumbersome mechanics of e-mailing Excel files back and forth go away, it becomes much easier to add new partners into the process. Whereas in the past you may have only interacted with the Vice chancellor of student affairs, now you are opening the process to the leaders of the career center, residential life, athletics, counseling, and student activities as well.

Eliminating manual processes from your planning process opens you to many possibilities. Plan more frequently. Plan in greater detail. Tap into the voices throughout your institution. Prophix helps you modernize the tedious and impractical components of your planning process and lets you focus on analysis and being a strategic partner to your university or college. To learn more visit here.

Insights for next-gen finance leaders

Stay ahead with actionable finance strategies, tips, news, and trends.