Download Analyst Report

17 Best Financial Reporting Tools for 2026

This guide looks at 17 of the best financial reporting tools for 2026. Each one helps finance teams make smarter decisions at every level.

June 17, 2025Today, financial reporting looks forward as much as it looks back. There’s no other option. With growth as a top priority in 2026, teams need financial reporting tools that deliver fast, accurate insights and clear direction to act on them.

Yet even as CFOs take the lead in analytics, over half still struggle to produce reports that stakeholders trust. That raises the stakes. Reporting tools have to both make day-to-day work easier and support strategy.

This guide looks at 17 of the best financial reporting tools for 2026. Each one helps finance teams make smarter decisions at every level.

What is financial reporting software?

Financial reporting software helps finance teams make sense of their numbers. It pulls data from spreadsheets, accounting systems, and other sources into one place. With clean data in hand, teams can:

- Identify trends, compare numbers, and track performance over time

- Create dashboards and reports that are easy to read and share

- Plan ahead using forecasts, what-if scenarios, and AI-powered insights

Finance teams are moving away from tedious data prep and toward faster, smarter reporting. That’s why more companies are turning to financial reporting tools, and the global market is responding. It’s set to grow from $10.70 billion in 2025 to $22.64 billion by 2032.

Comparison of the top financial reporting tools

Growing pains hit hardest in financial reports. As businesses scale, the cracks start to show, manual work slows everything down, and it gets harder to trust the numbers or stay compliant.

These problems show up in real ways. Nearly 1 in 5 accountants deal with daily errors, and another 24% say manual tasks hold them back.

The right tool simplifies reporting. It offers a single source of truth, making it easier to build accurate reports and stay on top of compliance. Here’s how the top financial reporting tools stack up.

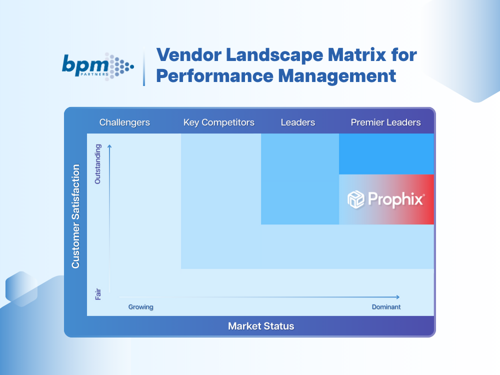

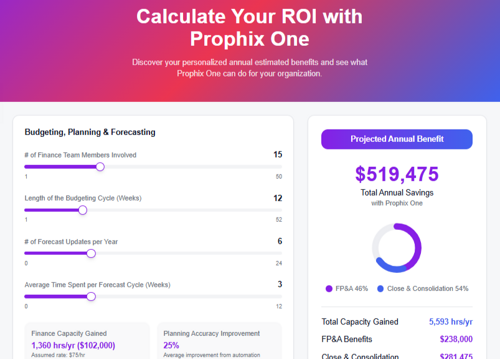

Prophix One, a Financial Performance Platform

Prophix One offers financial reporting software that supports finance teams with automated reporting, real-time data, and built-in AI. It works well for companies with complex financial needs.

Features:

- Report templates and automated distribution

- AI-powered financial report narration and insights

- Data collection and validation through data integrations to HRIS, ERP, CRM and more

- Visual analytics with interactive charts and graphs

- Role-based access and permissions

Pros:

- Robust security protocols including SOC2, ISAE3402, CSA Level 1, ISO 27001:1013, TRUSTe Enterprise Certification

- User-friendly for non-technical teams—easily build customized dashboards and reports

- Highly regarded customer support, including the Continuous Success Package

Cons:

- May be too robust for small businesses and teams

Integrations:

- Pre-built connectors for CRM, ERP, HRIS systems and more

- Connect to diverse systems using API, FTP/SFTP, JSON, SOAP and ODBC

Pricing:

- Pricing varies on the number of users, applications, and integrations. Book a call to learn more about pricing.

Cube

Cube turns manual spreadsheet workflows into real-time reporting. It automates variance analysis, centralizes data, and supports drill-downs in Excel and Google Sheets.

Features:

- Real-time variance analysis and drill-downs

- Excel and Google Sheets compatible

- Version control and role-based access

Pros:

- Great for spreadsheet-heavy teams

- Cuts down manual work

- No IT setup needed

Cons:

- Not ideal for complex planning at enterprise scale

Integrations:

- Connects to ERPs, CRMs, and HR tools

- Built-in support for NetSuite, Salesforce, and Workday

Pricing:

- Custom quotes only

- Demo required

Oracle NetSuite

NetSuite offers real-time financial reporting with support for multi-entity data and global standards. It works well for both simple and complex reporting needs.

Features:

- Customizable reports

- Real-time dashboards

- Multidimensional analysis

Pros:

- Reduces manual work

- Adapts to team needs

- Scales easily

Cons:

- Setup can be complex

- Custom reports may need dev help

- Add-ons increase cost

Integrations:

- Connects to CRM, ecommerce, and logistics

- Centralized via NetSuite Connector

Pricing:

- Annual subscription + setup fee

- Reporting included in license

Intuit QuickBooks

QuickBooks helps small and mid-sized businesses track financials with easy built-in reporting.

Features:

- Real-time P&L, cash flow, and balance sheet reports

- Custom reports (Advanced plan)

- KPI dashboards

- Scheduled sharing

Pros:

- Simple setup

- Live data

- Custom formats

Cons:

- Limited depth on lower plans

- Custom reports need the Advanced plan

Integrations:

- Works with 750+ apps and spreadsheets

Pricing:

- Starts at $28/month

- Advanced plan: $190/month

- 30-day free trial

FreshBooks

FreshBooks offers simple, real-time financial reports for small businesses. Reports like profit and loss and cash flow are easy to read and share.

Features:

- P&L, expense, and tax summaries

- Real-time dashboards

- Project profitability (Premium+)

- Easy export for accountants

Pros:

- User-friendly

- Great for freelancers and small teams

- Speeds up tax time

Cons:

- Limited customization

- Fewer features on lower plans

- Not ideal for growing firms

Integrations:

- Gusto, HubSpot, Zapier

- Mobile access on iOS and Android

Pricing:

- Lite: $6.60 CAD/month (5 clients)

- Plus: $10.50 CAD/month (50 clients)

- Premium: $18.00 CAD/month (unlimited)

- Select: Custom pricing

Basic reporting on all plans; advanced tools start with Plus.

Sage Intacct

Sage Intacct gives finance teams real-time, multi-entity reporting with custom reports and deep visibility into financial and operational data.

Features:

- 150+ built-in reports

- Custom report builder

- Multi-dimensional general ledger

- Real-time dashboards

- Role-based access and permissions

Pros:

- Great for complex, multi-entity reporting

- Easy custom reports

- Tracks ops and financials

- Saves time

Cons:

- Requires setup

- Too advanced for small teams

- No public pricing

Integrations:

- Works with CRMs, ERPs, payroll, billing

- Built-in collaboration tools

Pricing:

- Custom quotes only

- Demo required

Insight Software

Insight Software connects to 200+ ERP and EPM systems for real-time financial reporting. It pulls live data into Excel, automates reports, and cuts manual work.

Features:

- Real-time ERP data in Excel

- Self-serve reports

- Dashboards and compliance tools

Pros:

- Works with major ERPs

- Reduces manual tasks

- No coding needed

Cons:

- Setup required

- May be complex for smaller teams

- No listed pricing

Integrations:

- Microsoft Dynamics, SAP, Oracle, NetSuite, Power BI

Pricing:

- Contact sales for a quote

Workday Adaptive Planning

Workday Adaptive Planning streamlines financial planning with flexible, no-code reporting and real-time insights.

Features:

- Drag-and-drop reports

- Real-time dashboards and variance analysis

- Scenario planning and audit trails

- Integrates with Microsoft 365 and Google Workspace

Pros:

- No coding needed

- Reduces spreadsheet use

- Supports drilldowns and flexible reporting

Cons:

- Requires some training

- No public pricing

- May be too complex for small teams

Integrations:

- Works with ERPs, CRMs, Excel, and Google Sheets

- Doesn’t require other Workday tools

Pricing:

- Custom quotes only

- 30-day free trial available

Board

Board delivers real-time reporting with no-code report building for finance and operations.

Features:

- Drag-and-drop builder

- Real-time dashboards

- Trend and drill-down analysis

- Business event alerts

- Mobile and desktop support

- Advanced charts

Pros:

- Easy for non-technical users

- Customizable

- Cross-device

Cons:

- Setup can be complex

- Interface may overwhelm new users

Integrations:

- Microsoft Office compatible

- Connects to various systems

Pricing:

- Custom quotes after demo

Xero

Xero offers real-time financial reporting for small businesses. It tracks key metrics and lets users customize reports easily.

Features:

- Real-time profit & loss, cash flow, and balance sheets

- Drag-and-drop layouts

- KPI tracking and report sharing

Pros:

- Easy to use

- Good customization for non-experts

Cons:

- Limited for complex reports

- Advanced features need higher plans

Integrations:

- Works with many apps for payments, payroll, CRM, and inventory

- Exports in multiple formats

Pricing:

- Starter $2.50 CAD/month (promo)

- Standard $5.50 CAD/month (promo)

- Premium $7.50 CAD/month (promo)

- Free 30-day trial included

Vena Solutions

Vena offers Excel-based financial reporting that centralizes data and automates tasks. It fits finance teams wanting flexibility and control without leaving familiar tools behind.

Features:

- Pre-built Excel templates

- Real-time data consolidation

- AI-powered insights

Pros:

- Familiar Excel interface

- Strong integrations

- Saves time and prevents errors

Cons:

- Setup may need IT support

- Some features cost extra

- Best for mid-size to large firms

Integrations:

- Connects with major GLs, SQL databases, and cloud storage

Pricing:

- Two packages with custom pricing

- Nonprofit discounts available

- Free consultation required

Planful

Planful helps finance teams build reports, track trends, and share insights in real time. It cuts manual work and boosts accuracy.

Features:

- Real-time reporting with drill-down

- AI alerts for unusual data

- Automated report delivery

Pros:

- Saves time with automation

- Easy data exploration

- Reduces errors

Cons:

- Complex for small teams

- Lengthy setup

- AI features need training

Integrations:

- Connects to ERPs, CRMs, and data warehouses

- Links to Power BI and Excel

Pricing:

- Custom pricing, demo required

Datarails

Datarails makes financial reporting easier by managing Excel workflows. It keeps data in one place, controls versions, and supports report creation within Excel.

Features:

- Automates period-end reporting using Excel

- Consolidates financial statements across teams

- Supports version control and real-time updates

Pros:

- Works within Excel

- Reduces manual errors and version confusion

- Scales across departments

Cons:

- Relies heavily on Excel—not a full SaaS solution

- Pricing requires contacting sales

Integrations:

- QuickBooks, Xero, NetSuite, SQL Server

- Supports Email, SFTP, and custom file sync

Pricing:

- Custom quotes based on users and needs

Jirav

Jirav simplifies financial reporting and forecasting for small to midsize businesses. It replaces manual reports with customizable dashboards and scenario analysis to speed decision-making.

Features:

- Financial and management reporting

- Budget vs. actuals tracking

- Rolling forecasts and board-ready templates

Pros:

- User-friendly dashboards and reports

- Fast setup with pre-built templates

- Strong “what-if” planning tools

Cons:

- Not suited for large enterprises

- Limited advanced modeling

Integrations:

- QuickBooks

- Xero

- NetSuite

- Sage Intacct

Pricing:

- Based on team size and features

- All plans include forecasting, dashboards, and guided setup

- Custom quotes available

SAP S/4HANA Finance

SAP S/4HANA Finance is part of SAP’s ERP for large enterprises needing real-time financial reporting and control. It centralizes data and supports complex global operations. Available on-premise, cloud, or hybrid.

Features:

- Real-time reporting

- Centralized data

- Compliance tools

Pros:

- Scales for enterprises

- Strong SAP integration

- Robust security

Cons:

- High costs

- Needs expertise

- Complex licensing

Integrations:

- Native with SAP ERP and Analytics Cloud

- Supports third-party APIs

Pricing:

- On-premise: $100K–$1M+

- Cloud: $20K+ monthly

- User licenses vary

- Extra setup and support costs

Synoptix

Synoptix connects to the ERP, making reporting easy with spreadsheet-style reports and live dashboards.

Features:

- Spreadsheet-style report builder

- Direct ERP connection

- Real-time dashboards

Pros:

- No IT needed for setup

- Fast implementation

- Accurate data from ERP

Cons:

- UI feels outdated

- Mainly for finance teams

Integrations:

- NetSuite, Sage, Microsoft Dynamics, QuickBooks

Pricing:

- Quote-based, varies by users and ERP

- Includes onboarding and support

Workiva

Workiva centralizes financial reporting, board presentations, and internal reports on one platform. It links data and text in real time, reduces manual work with automation, and keeps everything current.

Features:

- Real-time linking across documents

- Automated report updates

- Version control and audit trails

Pros:

- Cuts manual errors

- Smooth team collaboration

- Strong audit and compliance tools

- Suited for high-stakes reporting

Cons:

- Steep learning curve

- Pricing is custom and not public

Integrations:

- Supports major ERP, BI, CRM, and file storage systems.

Pricing:

- Custom quotes based on company size and needs.

Jedox

Jedox helps teams create accurate financial reports, dashboards, and forecasts with consistent data. It combines reporting, planning, and automation.

Features:

- Automated reports

- Real-time dashboards

- Templates for P&L and cash flow

- AI-assisted planning

Pros:

- Works with Excel and PowerPoint

- Customizable and scalable

- Integrates with SAP, Snowflake, Power BI

Cons:

- Setup takes time

- Advanced features cost extra

Integrations:

- Connects with ERP, CRM, BI tools

- Supports SAP, Oracle, Salesforce

Pricing:

- Tiered plans based on features and users

Zoho Books

Zoho Books delivers strong reporting tools for small businesses needing clear financial insights and compliance.

Features:

- Built-in profit & loss, balance sheet, cash flow, and tax reports

- Custom layouts, tags, formulas

- Scheduled reports and audit trails

- Mobile access and Zoho Analytics integration

Pros:

- Easy report creation and sharing

- Customizable to business needs

- Automated scheduling saves time

Cons:

- Advanced features need higher plans

- Not for large enterprises

Integrations:

- Works with Zoho apps, Stripe, PayPal, Avalara, G Suite, and Office 365

- Connects to 500+ apps via Zapier

Pricing:

- Free plan available

- Custom reporting from $15/month

- Advanced analytics at $290/month

- 30-day free trial

Determining the right financial reporting solution

Today’s teams need less hindsight and more foresight. That means using financial reporting tools that help finance shift focus from past data to future planning.

Producing accurate financial reports in 2026 starts with clean, connected data. The right tools link directly to your source systems, cutting down time spent fixing errors. This frees up time to focus on the insights that matter, while up-to-date data builds trust in reports and the decisions they support.

With trusted data in hand, teams gain a clearer view of financial health. Custom dashboards and filters make it easier to spot trends, compare performance, and catch issues early.

Look for solutions that:

- Automate reporting to save time and reduce errors

- Support compliance by keeping data accurate

Remember, when reporting is strong and reliable, it shifts finance from a back-office function into a growth engine.

Key features financial reporting tools should have

On paper, many financial reporting tools look alike. But once report building begins, the differences become clear. And when the pressure’s on, these are the features that matter most:

- Data integrity and accuracy: Clean data is the foundation of reliable reports. Getting close to 100% accuracy is key for solid forecasts and budgets. Integrated tools help by applying consistent rules and cutting down on manual fixes.

- Real-time reporting and drilldowns: When numbers shift, real-time reporting and drilldowns deliver instant access to details without relying on outdated exports or extra steps.

- Security and access controls: Security is a baseline requirement. Since 95% of cybersecurity incidents stem from human error, features like user-level permissions and audit trails are essential to protect sensitive data while enabling safe team collaboration.

- Compliance-ready reporting: Regulations move fast. Built-in audit logs and consistent calculations help teams stay compliant without extra manual work.

- Financial disclosure management: Helps teams collaborate on reports and filings in one place. Dashboards and task tracking keep everything visible and on schedule.

- Analytics and variance insights: Great reports explain the “why.” Built-in analytics, and in some cases, AI, can cut down the time spent on manual analysis.

- Integrated dashboards: Dashboards help teams understand performance faster and make quicker decisions.

- Scalable collaboration: As teams grow, reporting needs to scale. Features like version control and automated workflows keep reports accurate and distribution smooth.

Reporting software needs by company size

The best financial reporting tools depend on the size and complexity of the business. What works for a 5-person team won’t cut it for a multi-entity enterprise. Here’s what to look for at each stage.

- For small businesses, focus on ease and speed. Choose a tool that’s simple to set up, affordable, and connects with existing accounting software like QuickBooks. Skip platforms loaded with features that won’t be used. They’ll just hold things back.

- For mid-sized companies, reporting gets more complex. More teams, more data, and tighter compliance raise the bar. Look for tools that scale, offer forecasting, budgeting, and planning. With 85% of FP&A teams saying they’re stretched too thin, automation can take the pressure off.

- For enterprise-level organizations, reporting needs to handle multiple entities, regions, and evolving compliance standards. For large teams to move faster and stay agile, look for tools with strong integrations, audit trails, and customizable reports.

Choose a tool that works today and won’t hold the business back tomorrow. CFOs are now expected to drive growth, not just track costs. The right software should do both.

Implementation and support considerations

Choosing a financial reporting tool is just the start. Without a smooth rollout and strong support, even the best software can fall short. And for teams still juggling messy systems and disconnected tools, the risk is even higher. None of it works without proper implementation. Good vendors don’t just hand over the software and walk away. They guide teams through setup, training, and adoption. When the system fits workflows, it’s easier to get value fast.

Look for vendors that offer:

- Hands-on onboarding and integration support

- Clear timelines and communication

Security also deserves attention. Cyber incidents are rising in both frequency and severity, especially during new tech rollouts. A shaky setup leaves teams vulnerable. The right support helps get things running faster and cuts down on time spent fixing problems.

Next steps: Streamlining financial reporting efficiency

Manual work is still a silent productivity killer. It delays close, leads to errors, and blocks a clear view of performance. All of that adds to the pressure on finance teams who are already expected to move fast and guide big decisions.

Automation breaks that pattern by giving teams more time to focus on higher-value work. In fact, Gartner points out that companies with high technology adoption report a 75% drop in errors.

Getting those results starts with the right foundation. First, identify where manual work causes the most strain. Then, choose financial reporting tools that handle the manual tasks and free up the team’s time.

Last updated November 2025

See how Prophix can improve your financial reporting today.