Download Analyst Report

Insights on FP&A, AI & Finance Transformation | Prophix Blog

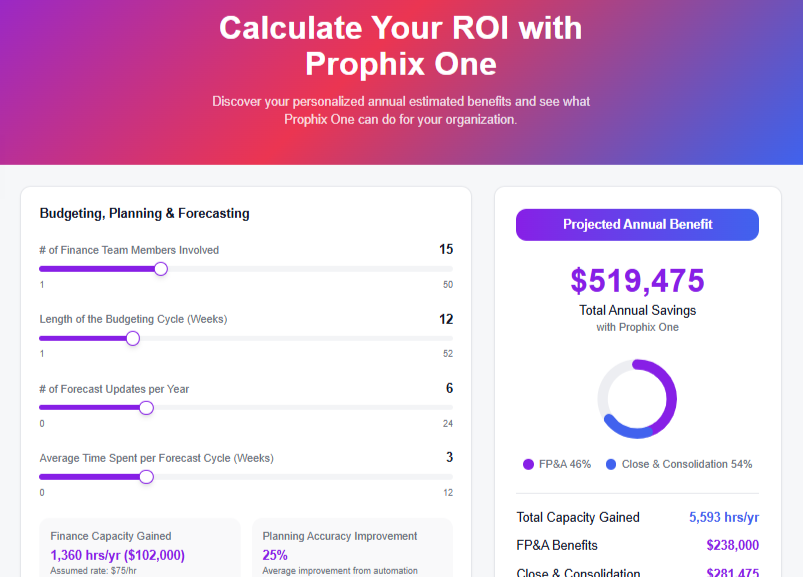

Prophix One Agents: The first step in autonomous finance

Prophix One Agents—your first step toward Autonomous Finance and a legacy of clarity, capacity, and confidence.

Read our story