Download Analyst Report

Annual Planning for 2026: Best Practices and Checklist for Finance Teams

Annual planning is important to businesses because it helps set clear goals, allocate resources, and anticipate future challenges, providing organizations with a structured roadmap for growth.

October 28, 2025For most companies, annual planning is the moment when strategy, finance, and operations converge to map the coming year. But great planning doesn’t end when the budget is approved. It’s a living process. For finance leaders, annual planning sets the foundation for a year of execution and agility. A strong plan brings clear financial objectives, aligns resources, and ensures the organization can pivot as conditions change.

And while plans are typically finalized early in the year, the annual planning process should never be static. The best teams continually monitor, adjust, and re-forecast to keep plans relevant throughout the fiscal year.

What is annual planning?

Annual planning is the structured process of reviewing past performance, setting goals, and allocating resources for the next fiscal year. It grounds strategic priorities in financial reality and creates a roadmap for growth.

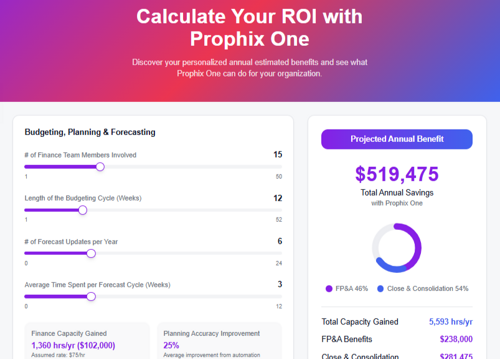

With Prophix One FP&A Plus, finance teams can streamline the annual planning process by consolidating data, automating workflows, and enabling scenario planning.

The importance of annual planning for businesses

Annual planning is important to businesses because it helps set clear goals, allocate resources, and anticipate future challenges, providing organizations with a structured roadmap for growth.

An effective annual planning process improves strategic alignment across departments and improves decision-making, helping to ensure everyone is prepared to support the company’s goals.

Integrated business planning tools can also help you understand the relationship between your data, from inventory planning to demand planning or capital planning, and bring everyone together for seamless collaboration across your business.

Why annual planning matters in 2026

- Strategic alignment: Annual planning ensures every department is working toward the same objectives.

- Agility in uncertainty: With shifting interest rates and global market pressures, annual planning in 2026 must support re-forecasting and scenario modeling to help teams respond quickly.

- Cross-functional collaboration: By engaging stakeholders early, finance fosters buy-in and better decision-making across sales, operations, HR, and marketing.

- Continuous improvement: Teams that revisit their annual plan regularly build a more accurate picture of performance and can adapt faster to opportunities or challenges.

See more in our guide on 10 best practices in financial planning and analysis.

How annual planning differs from other types of planning

Annual planning differs from other types of planning because emphasizes long-term goals, with a specific focus on strategies for the fiscal year. Other types of planning are usually more short-term or project specific.

Annual planning also includes an in-depth review of past performance and prior resource allocations, in order to identify areas for improvement in the upcoming year. In contrast, other types of planning don’t necessarily include a retrospective component and can be focused solely on forward-looking activities.

With Prophix One you can prepare both short- and long-term plans with financial forecasting, helping you align your plans with broader organizational objectives.

Get 6 proven tactics for smarter, faster forecasts in 2026

Key components to include in an annual financial plan

There are several key components of an effective annual plan, including:

- Defined goals: Clearly stated objectives that outline what the organization aims to achieve within the year.

- Detailed action steps: Specific tasks and initiatives required to achieve the defined goals.

- Timelines: Target dates that establish when each action step and goal should be completed.

- Resource allocation: Assignment of people, tools, and materials needed to execute the plan effectively.

- Budgets: Financial plans that outline the costs associated with achieving goals and completing tasks.

- Performance metrics: Measurable indicators used to track progress and evaluate success throughout the year.

- Contingency plans: Backup strategies to address unexpected challenges or changes in the plan.

It’s no secret that all of these components can be difficult to manage in Excel. But bringing all of these processes into a unified platform can help you streamline the preparation and management of these annual planning components to ensure clarity and efficiency in execution.

Preparing for planning season

To prepare for planning season, usually October to January, there are several steps you can take:

- Establish clear goals: Guide teams on setting specific, measurable objectives aligned with the organization’s strategic vision. Prophix One can easily surface data-driven insights to help inform these goals.

- Collaborate across departments: Engage stakeholders early in the process to gather relevant data and foster buy-in. Prophix One FP&A Plus can support cross-departmental collaboration with shared data and reporting.

- Create a detailed timeline: Develop a timeline with key milestones for the annual planning process. Prophix One can automate progress monitoring, helping teams stay accountable and on schedule.

Next, let’s look at what’s involved in the ongoing management of annual plans.

Ongoing management of annual plans

Annual planning is an ongoing process that requires continuous management, including:

- Regular monitoring: Track performance against KPIs to see how plans are aligning with outcomes. Reporting and analytics software enables real-time performance monitoring, so you can act quickly when plans stray from reality.

- Mid-year reviews: Conduct mid-year reviews to allow your teams to assess progress and adjust strategies as needed. Prophix One has scenario planning capabilities that can support regular re-forecasts of annual plans.

- Re-forecasting and revising: Revise forecasts based on changing conditions. Flexible modeling capabilities allow finance teams to test multiple “what-if” scenarios to guide decisions.

- Continuous improvement: Use insights gathered from continual monitoring to refine your future planning process. With Prophix One, finance can drive a culture of adaptability built on accurate, real-time data.

Now that you’re familiar with how to monitor your annual plan throughout the fiscal year, let’s explore how to ensure you implement your plan successfully.

2026 Annual planning checklist

Pre-planning (October-December 2025):

- Define top strategic priorities

- Build a planning calendar with deadlines

- Review and validate current-year data

- Engage key stakeholders across departments

Planning season (December 2025-January 2026):

- Gather departmental budgets and forecasts

- Align initiatives with corporate goals

- Run scenario analyses (best, base, worst case)

- Finalize budgets and secure sign-off

Ongoing management (February-December 2026):

- Track KPIs regularly

- Conduct mid-year re-forecasts

- Adjust resources and assumptions as needed

- Document insights for the next cycle

Ensuring successful implementation of your annual plan

To ensure the successful implementation of your annual plan, there are several best practices to follow, including:

- Set clear goals: Begin by defining specific, measurable, achievable, relevant, and time-bound goals. Clear goals provide direction and prioritize efforts, ensuring that everyone understands the objectives and what success looks like. For example, instead of a goal like "increase sales," you could set a precise target like "increase sales by 15% by the end of Q4." This clarity motivates teams and aligns their actions with the organization's bigger picture.

- Assign accountability leaders: Designate individuals or teams to oversee specific goals and initiatives. Accountability leaders ensure that tasks are executed on time, resources are used effectively, and any obstacles are addressed proactively. Communicate their responsibilities clearly and empower them to make decisions that drive progress.

- Regularly monitor progress through metrics: Use performance metrics to track how well you're meeting the plan's goals. Schedule regular check-ins—monthly or quarterly—to review progress, celebrate achievements, and identify areas that need improvement. For example, reviewing a sales metric might reveal whether marketing campaigns are driving the desired impact. Monitoring metrics provides valuable insights and helps teams stay on track or adjust as needed.

- Adapt to unforeseen challenges: Even the most well-crafted plans may encounter unexpected obstacles, such as changes in market conditions, resource fluctuations, or internal setbacks. Develop contingency plans and remain flexible to pivot when necessary. Encourage open communication so teams can address challenges early and collaboratively find solutions.

And finally, for many finance teams, FP&A software like Prophix One FP&A Plus, is the final key to the successful implementation of annual plans. With the ability to assign task owners and multiple approvers, set reminders and deadlines, distribute budgets automatically, and track changes for transparency, you can enhance communication and resource alignment throughout the annual planning process.

Key takeaways for financial annual planning

The annual planning process is important to finance teams as it’s a way to align organizational resources and budgets with long-term goals and priorities.

The annual planning process is also an ideal time for finance teams to collaborate with other departments to better understand their needs for the upcoming year, as well as set clear goals, and anticipate future challenges.

With Prophix One FP&A Plus, finance teams can remain adaptable, with tools to support the continuous monitoring and adjustment of annual plans, helping organizations navigate a challenging economic landscape.

See how finance teams gain real-time cash visibility with Prophix One.