Download the BPM Partners Whitepaper

FRS 102 COMPLIANCE

Streamline your path to FRS 102 lease accounting compliance

Why choose Prophix One™ for FRS 102 compliance?

Ensure compliance with the latest FRS 102 update

Stay ahead of regulatory changes with a lease accounting solution designed for your compliance needs. Seamlessly manage the complexities of lease accounting and financial reporting in line with the updated FRS 102 standard.

Automated contract review and reclassification

Automated review and reclassification streamline your contract analysis by quickly identifying leases and applying the correct accounting treatment, reducing manual effort and ensuring accurate compliance.

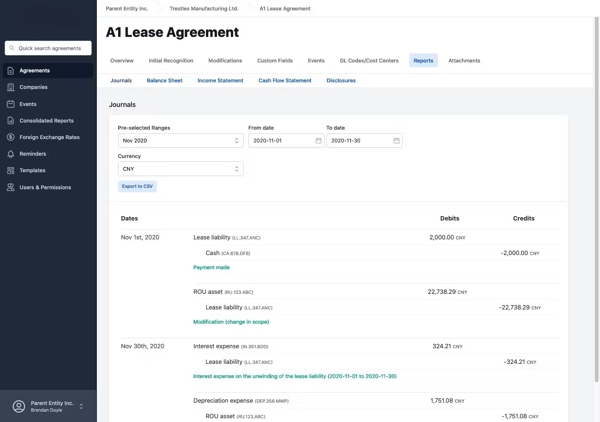

Track modifications and maintain data integrity

Rely on accurate, up-to-date lease data and transparent calculations. Effortlessly monitor all changes to your leases and improve auditability across your lease accounting processes.

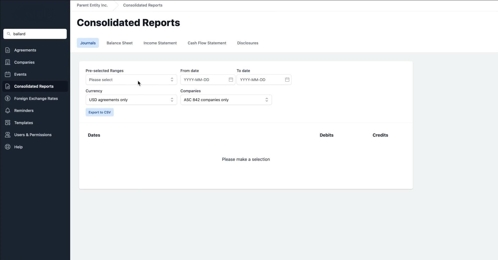

Centralized data management

Centralize all lease and contract data in one secure platform to minimize errors and ensure easy access for reporting and audits.

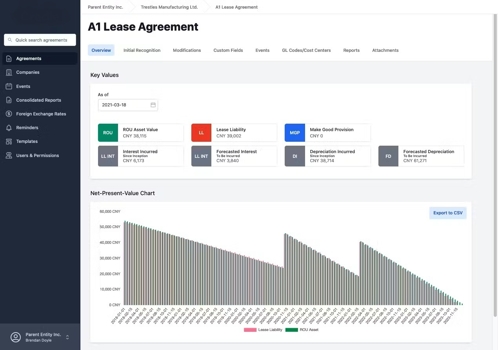

Understand the balance sheet impact of leases

Gain clear visibility and control over your lease portfolio as new FRS 102 requirements bring leases onto your balance sheet. Ensure transparency and readiness for how these changes will affect your financial position and reporting. With better insight into key leasing events, you can make informed decisions and maintain agility in a rapidly evolving regulatory environment.

Enhance control and transparency in lease management

Take charge of your lease portfolio with improved oversight of key leasing events and greater transparency. By strengthening control and visibility, your organization can respond swiftly to changes, ensure accurate reporting, and maintain compliance in today’s fast-paced regulatory environment.

Driving reporting accuracy and data confidence

Finance as we know it is changing

What does next generation financial reporting and analytics software look like for the Office of the CFO? Learn how to research, evaluate, and purchase financial reporting and analytics software in the Ultimate Financial Performance Platform Buyer's Guide.

Made for finance leaders

Discover Prophix One and unlock your potential for success.

Reporting & Analytics

Increase data accuracy and reporting efficiency, affording you more time for valuable analysis.

Financial Consolidation

Streamline close windows by eliminating manual processes and automating recurring ones.

Automation & Workflow

Accelerate financial processes and improve collaboration.

AI Insights

Gain a deeper understanding of your business with AI.

MS365 Add-In

Boost Excel’s financial modelling and planning capabilities and create insightful PowerPoint presentations.

Integrated Business Planning

Gain visibility across your business with integrated cross-functional business planning.

Account Reconciliation

Collaborative account reconciliation for smarter, faster financial close.

Frequently asked questions

What is lease accounting software?

Lease accounting software helps organizations comply with lease accounting standards like IFRS 16, ASC 842 and FRS 102 by automating calculations, financial reporting, and disclosures. It centralizes lease data management and offers features for managing lease renewals, modifications, and payments. Additionally, lease accounting software provides tools for multi-entity reporting and maintaining audit trails, ensuring accuracy and compliance in lease accounting.

What are the benefits of using lease accounting software?

Lease accounting software streamlines compliance with complex accounting standards, reducing the risk of errors and ensuring accurate financial reporting. It also enhances efficiency by automating lease management tasks, improving data organization, and supporting strategic decision-making with advanced reporting and analysis tools.

How customizable is lease accounting software?

Lease accounting software is typically customizable to meet the specific needs of different organizations. Users can often tailor data collection, reporting templates, as well as adjust settings for lease classifications, currency management, and multi-entity structures.