Download the BPM Partners Whitepaper

How to accelerate your finance career

In this guide, we’ll cover what the next generation of finance means for your career.

November 20, 2024In 2023, 8.4% of vacant CEO positions were filled by CFOs, highlighting the adaptability, expertise, and value of finance roles.

If you’re looking to accelerate your career in finance—from CFO to CEO, or from Analyst to Director—there are steps you can take to position yourself as a strategic advisor within your organization.

Embracing the next generation of finance technology is part of this shift, changing the way you work and freeing up time to focus on delivering value in your role.

In this guide, we’ll cover what the next generation of finance means for your career and how finance technology can be an accelerant, including success stories from finance leaders who are driving positive changes in their organizations.

What the next generation of finance means for your career

Finance is changing—there’s a growing appetite for new, innovative processes and unique perspectives that will change the career trajectory of finance leaders.

Driving this change is the proliferation of game-changing finance technology that allows CFOs to move beyond the “way it’s always been done” and usher in an era of radical change.

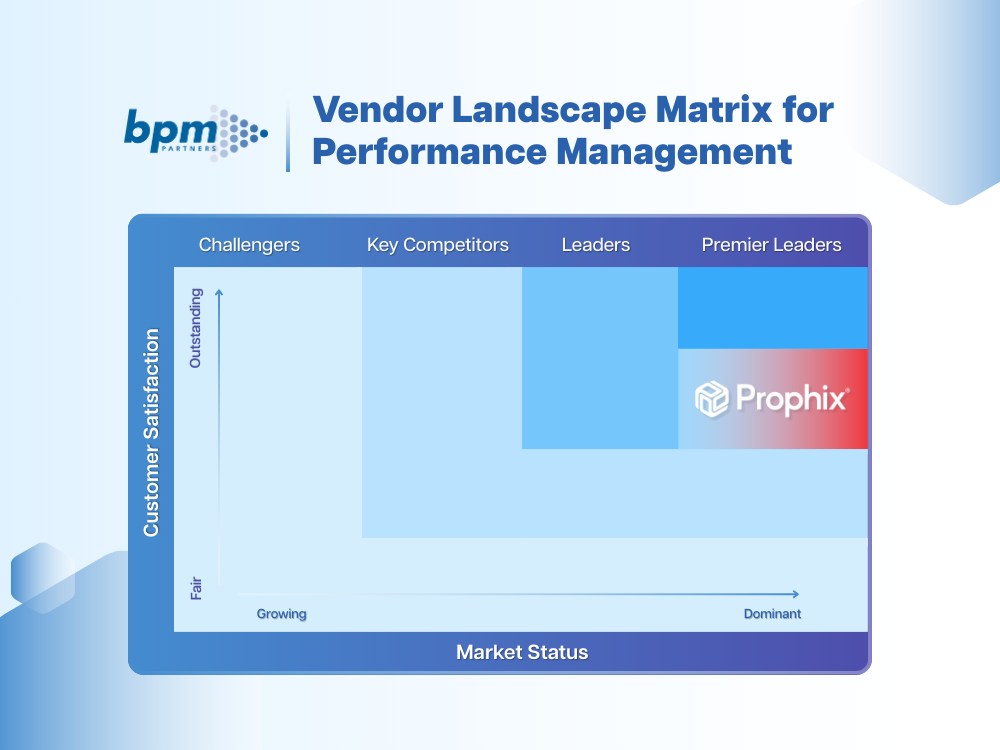

Finance leaders who’ve already adopted a financial performance platform, like Prophix One, are leading this evolution, introducing new ways of working that put finance in the driver’s seat.

Note: Financial performance platforms can also be referred to as FP&A software or financial performance management (FPM) software.

It’s clear then that the next generation of finance will be defined by those who are using finance technology to its greatest potential, redefining their roles to focus more on strategic advice and decision-making, rather than number crunching.

Let’s dive into some key traits of successful finance leaders.

Traits of successful finance leaders

In a recent webinar, Strategy Over Spreadsheets: Building the Next Generation of Finance Leaders, we asked three CFOs what traits they look for in finance leaders:

- Strategic thinking – The ability to use financial data to inform strategic decisions that positively impact the bottom line, and to think creatively and critically when facing challenges.

- Communication – The skill to synthesize insights from across the organization and present them in a way that is easily understandable to those outside of finance. Communicative finance leaders work cross-functionally to improve processes and align organizational goals with departmental needs.

- Resiliency – A growth mindset that enables finance leaders to anticipate change, adjust processes, and adopt the latest technology to keep the business competitive.

Next, you’ll hear from finance leaders who embody these traits and use finance technology to their advantage.

Success stories from next-gen finance leaders

Denise Feece’s journey to CFO

Denise Feece began using Prophix in 2008 when she became the sole member of a manufacturing company’s finance team. Without any support, she had to figure out how to publish financial statements, put together a forecast, and generate reports independently.

She quickly realized the company wasn’t using Prophix One, a Financial Performance Platform, to its fullest potential. This insight laid the foundation for her career acceleration—she knew if she committed to mastering finance technology, she could transform finance and her career.

To deliver more value in her role, Denise has developed 48 financial models in Prophix One across various companies, each designed to easily address questions from the CEO, salespeople, or business unit managers.

In her current role as CFO and COO of Sequel Wire and Cable, Denise closely monitors and controls the material content in their products, ensuring production aligns with organizational goals.

Her commitment to using the next generation of finance technology, like Prophix One, has driven decisions, improved processes, and encouraged customers to buy more products, ensuring her business is profitable and helping her rise into her role as CFO.

Discover how Denise Feece accelerated her career with Prophix One™—and how you can too.

Jonny Harmer’s quest for cash flow clarity

Not all career moves are about getting a promotion; sometimes, they’re about solving the challenges that keep you up at night.

Jonny Harmer, CFO at USA Properties, was losing sleep over his organization’s cash flow—wondering if there would be enough cash to cover upcoming projects and sustain operations until investments generated returns.

With Prophix One, Jonny was able to better plan during the pre-construction phase and accurately assess project costs before they began. This not only eased his concerns but also accelerated the careers of his finance team by enabling them to work more efficiently, effectively, and productively, leading to greater job satisfaction.

The implementation of Prophix One resulted in a 50% increase in budget accuracy and a 6.7% increase in operating margins for USA Properties, allowing Jonny and his team to deliver more value in their roles.

“The number one thing I would tell a finance leader thinking about Prophix One is that it has been a transformational tool for us. It has helped us identify areas where we can improve our efficiency, forecasting, and budgeting. And it’s helped our team members to be more engaged in value-added activities.” – Jonny Harmer, CFO, USA Properties

Tom Kennedy’s path to streamlined success

As a Financial Systems Analyst at Skanska USA, Tom Kennedy was responsible for updating and managing over 250 Excel spreadsheets, which created challenges for data security and accuracy.

After implementing Prophix One, a Financial Performance Platform, Tom used workflows to send out templates to users, eliminating the need for spreadsheets.

This transformation allowed Tom to streamline his processes and collaborate more effectively with stakeholders, helping them better manage their costs and analyze spending. By freeing up time from manual tasks, Prophix One also enabled Tom to participate in more strategic discussions where he can provide valuable insights.

While Tom didn’t transition into a new role, he significantly improved his job satisfaction and support for teams outside of finance—accelerating his career in his own unique way.

“With the extra time, I’ve been able to make improvements in our processes, working in conjunction with programs like PowerBI to create new reports and work on my own career development.” – Tom Kennedy, Financial Systems Analyst, Skanska USA

4 ways to attract top finance talent to your organization

If your goal is to hire top finance talent and help them accelerate their careers, consider these four strategies to appeal to the next generation of finance leaders:

- Use cutting-edge technology – The latest finance technology not only streamlines operations but also attracts young talent by eliminating tedious tasks that can negatively impact job satisfaction.

- Offer flexible work arrangements – Providing remote or hybrid work options broadens your talent pool, making your organization more appealing to finance professionals seeking flexibility.

- Emphasize ESG commitment – Younger generations are increasingly drawn to companies with strong ethical standards and a positive environmental impact. Highlight your organization's Environmental, Social, and Governance (ESG) initiatives to attract value-driven candidates.

- Invest in continuous learning – Offering opportunities for professional development, such as certifications and ongoing training, appeals to finance leaders eager to stay at the forefront of their industry.

Conclusion: Accelerate your finance career with Prophix One™

Finance leaders eager to accelerate their careers and deliver more value should embrace next-gen finance technology like Prophix One. This approach can transform how you work, freeing up time to focus on value-added activities.

By embodying leadership traits such as strategic thinking, communication, and resilience, you can achieve results like Denise Feece, Jonny Harmer, and Tom Kennedy.

See what you can do for your career with Prophix One™

Insights for next-gen finance leaders

Stay ahead with actionable finance strategies, tips, news, and trends.