Download the BPM Partners Whitepaper

How to Use Finance Software for Construction Cost Management

Discover how specialized finance software transforms construction cost management to prevent overruns, improve visibility, and deliver projects on budget.

May 7, 2025As real estate prices soar worldwide, there is increasing pressure on the construction industry to start, optimize, and complete projects in record time with ever-decreasing margins. Construction cost management—accurately forecasting and budgeting what a project will cost—is becoming increasingly important. Construction companies need to secure cash flow to sustain projects that can potentially take years to complete while managing any unexpected costs along the way. Conversely, public officials and lenders need an accurate picture of a project’s cost to abide by regulatory requirements or get funding.

Too many project managers and finance teams still use spreadsheets and similar inefficient methods, making cost management an uphill battle. Financial planning and analysis (FP&A) software, makes managing costs in construction a breeze, no matter what your project throws at you.

The challenges of cost management in construction

Any seasoned manager in construction can look over a site and see all the costs needed to keep it running: raw materials, labor costs, equipment, permits, and more. But as obvious as these costs are, they can be incredibly difficult to manage. If a crucial piece of equipment breaks down because you improperly forecasted your maintenance costs, you can’t just move numbers around until everything makes sense. You have a very real problem on your hands, and that equipment has to be fixed or replaced. Otherwise, the entire site could be shut down, leading to greater costs and cash flow problems.

Managing costs in construction comes with several challenges, the consequences of which are uniquely represented on the work site:

- The sheer amount of data: Everything on a construction site is associated with a list of costs, the transactions for which can easily number in the thousands. That’s a massive amount of data to process and plan around.

- Few dedicated connected tools: While your construction project management platform is fantastic for handling the complexities of your project, it’s rarely suited to properly managing its costs. Disconnected systems lead to more time spent reconciling numbers than making strategic decisions.

- Cost overruns: Every project risks running into unexpected costs and nowhere is that truer than in construction. An early miscalculation of necessary materials, a sudden breakdown of essential equipment, or an unexpected change request can all increase costs.

- Project delays: Whether it’s caused by inclement weather, changes in regulations, or having to temporarily pull funding from one project to supply another, delays can quickly get expensive.

- Escalating equipment costs: Rising fuel costs, a sudden need for new equipment, or even just maintenance costs can all completely change your cost analysis.

- Late payments and unpredictable cash flow: Anyone who’s worked on a construction project knows that late payments are possible. A single late payment can quickly start a chain reaction, jeopardizing cash flow across multiple projects.

- Reliance on credit and short-term loans: Many construction projects are financed with debt, which makes calculating costs and expenses more challenging. Additionally, many loans are paid out gradually as your project progresses. That means any project delays can result in cash flow issues.

- Scope creep and change orders: Even small changes to a project’s scope either by client request or unforeseen issues can significantly impact the budget. Change orders often come late and without full documentation, making it hard to forecast and control costs accurately.

While cost management challenges can directly affect your construction projects, the right FP&A software can mitigate their impacts.

Leveraging finance software for construction cost control

Using the right FP&A software can completely transform the way you manage costs by automating processes that rely on manual data collection and analysis, and helping you make more of that data regardless of your skill level. Project costs can become more predictable, putting you more than just a step ahead of the next challenge.

When you use the right FP&A software, you’ll start to see the benefits of improved construction cost management:

- Better visibility on costs: Not all construction costs are easy to manage. Now you can properly track more complicated costs like equipment depreciation. With finance software, you can drill deeper into specific cost allocations too, like job cost forecasting, work-in-progress (WIP) reporting, bid profitability analysis, and supply chain and procurement planning.

- Increased profitability: Finance software can automatically track, categorize, and analyze project costs, giving you the data you need to use every dollar more efficiently.

- Stronger cash flow management: When managing multiple projects, a single delay can quickly cause a chain reaction. FP&A software gives you better oversight on cash flow for every project, helping you identify potential issues before they come up and building resilience into every project.

- Better decision-making: Finance software puts data at your fingertips, no matter how many projects you’re running, or unexpected costs come up. Even better, that data can typically be represented in visual dashboards, meaning you can share important insights with the rest of your team and make better decisions together.

- Better compliance and auditability: Finance software standardizes your processes and creates a digital paper trail of all your activities. That makes it easier to stay compliant with regulations and accounting standards. It also makes you more prepared for audits, since you’ll be able to produce necessary documentation without any extra work.

- Greater financing capacity: The more accurate your finances, the easier it is to secure financing from banks and other lenders. Finance software can help you get everything in order quickly and efficiently, giving you access to better financing options.

- Lower equipment maintenance costs and less downtime: With improved construction cost management practices, you get more visibility on how much each piece of equipment is being used and when it needs maintenance. You’ll get more out of every piece of equipment and fewer projects grinding to a halt when crucial equipment breaks down.

- Increased growth: Having a better handle of your costs ultimately leads to more cost-effective projects, meaning more profits and a stronger growth trajectory for your company.

FP&A software streamlines cost management, automates your processes, and gives you a better view of your project’s needs. It will stabilize your cash flow and help control your costs. Now, how do you know which platform to pick?

Key elements of finance software for better budget control in construction

Not all finance software is created equal. When looking for software that’ll improve the way you manage costs for construction projects, make sure to evaluate the following characteristics.

Automated workflow management for streamlined approvals

Some of the workflows involved in construction cost management include budgeting, forecasting cash flows, balancing accounts receivable and payable, expense tracking, and billing. By automating these workflows, your finance software can eliminate approval bottlenecks, reduce the risk of manual error from data entry, and create digital audit trails. This saves precious time for project managers and the finance team, which can go towards responding to surprise costs or building better plans for each project.

Financial workflow automation in Prophix One FP&A Plus accelerates your financial planning, projections, and every aspect of managing costs for your construction projects.

Real-time financial dashboards and reporting

One of the biggest challenges of construction cost management is having to simultaneously build robust plans while staying flexible enough to react to unexpected costs or delays. Notably, having the necessary data to perform both tasks can be challenging, and often relies on significant manual work and multiple spreadsheets.

Work-in-progress (WIP) reporting is a critical process for many construction businesses as it provides a view of financial health with insights into profitability, project progress, and cash flow. CFOs lose sleep over WIP report inaccuracies. FP&A software allows you to report on what-if scenarios so you can better forecast cost fluctuations, assess revenue recognition timing, and optimize your cash flow – all using real-time WIP data. Not only that, but dashboards with real-time data allow for drill down into variables for stronger budgeting and forecasting.

Seamless accounting system integration

Your accounting system can likely produce useful reports for certain scenarios, but it may support actively managing costs on current projects. Additionally, having to manage individual transactions in your accounting system as well as your construction management software can lead to double-entry, inconsistent data across platforms, and compliance risks.

Software with the right financial data integrations can serve as a bridge between essential systems, streamlining collaboration and allowing your teams to better evaluate costs, no matter where they’re recorded.

Predictive budget analytics

The experience of your project managers and finance teams is invaluable, allowing them to properly respond to challenges in construction projects. But their instincts aren’t necessarily all you should base your cost management practices on. If your firm has built any number of projects, it will have a ton of historical data to base forecasts, budgets, and more on. Crawling through this data manually can take a significant amount of time you might not have. It’s also not always the most accurate method.

Predictive analytics can turn historical data into forecasts of future costs and establish patterns leaders can use to predict and work around future variance. Prophix One FP&A Plus uses AI-powered financial analytics to increase the accuracy of budgeting and forecasting, so you always know what to do, no matter what surprises lurk in your next project.

Choosing the right construction finance software for your business

Beyond simply ensuring that the software you choose has all the features you need, there are two primary characteristics you should look for in your finance software: assess compatibility (or integration) and scalability.

Assess compatibility and integration

Your finance software should integrate seamlessly with the systems you’re already using, whether that’s construction project management software or an accounting system. That way, all the data you need to manage costs is kept in one place. Most construction firms use spreadsheets to patch the gaps between multiple platforms, but this leads to an excess of manual work, complex formulas that break when transferred between systems, and workbooks that eventually become completely unusable.

While the idea of being able to do everything from a single platform can feel overwhelming—or, at least, making the switch is—it’s a much more efficient option for most firms. Imagine your accountants, project managers, and even your CFO being able to consult the same dashboards, fed with the same data, in a single tool.

Plan for long-term scalability and decision-making

Before choosing finance software, ask yourself if it’s only a good fit for your company at its current size or if it will scale with you. Many examples of top-performing tools can support organizations of a certain size, but quickly start lacking in functionality as they grow. Worse, they may not even be able to handle particularly large datasets, leaving you waiting for your dashboards to refresh every time you need to make a decision.

Cloud-native solutions with dynamic scaling are preferable. This means the software, like FP&A Plus, automatically increases available resources as your datasets increase so you’re never sacrificing performance. Not all software advertise this capability openly, and some don’t offer it at all, so ensure you’re asking about this when acquiring your financial software of choice.

How Prophix transforms construction cost management for sustainable success

Using fully integrated finance software for construction cost management brings several advantages. You can centralize data from multiple sources, allowing anyone in your company to consult reports, plan for unexpected costs, and manage cash flows for important projects. You’ll have an automatically generated paper trail that keeps you compliant with accounting best practices and makes working with an auditor easier. Whether it’s for WIP reporting, equipment management, job level working capital management, and more – you’ll have better visibility on your costs and the tools to manage them more effectively.

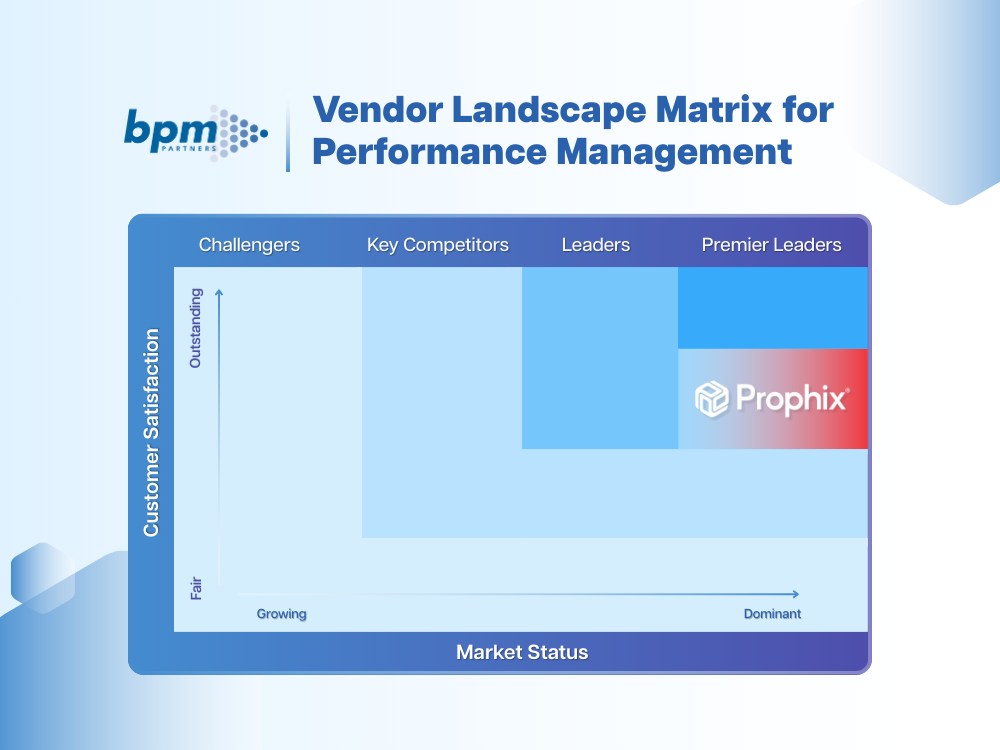

The best software for doing this? Prophix One FP&A Plus.

The Prophix One platform is built to support even the most complex cost management needs while offering everyone the ability to build dashboards and drill down into individual expenses. Here are examples of Prophix customers in construction and how they’ve optimized their financial processes:

- USA Properties Fund increased its budget accuracy by 50%. Combined with the stronger cost management they achieved with the platform, this resulted in a 6.7% increase in their operating margin.

- Skanska USA Building Inc. saved six hours a month on building essential financial reports, and their forecasting process went from requiring six people and multiple days to being handled by a single person in a few hours.

Want to see how Prophix One FP&A Plus can help your cost management process?

Insights for next-gen finance leaders

Stay ahead with actionable finance strategies, tips, news, and trends.