Download the BPM Partners Whitepaper

Automation In Finance: Machine Learning, AI, and Beyond

Big data is a big deal for business in the 21st century. The race is on to collect more data, process it into insight, and move ahead of the competition. The office of finance works with the bigges

November 14, 2018 Big data is a big deal for business in the 21st century. The race is on to collect more data, process it into insight, and move ahead of the competition.

The office of finance works with the biggest data in the organization. As businesses seek to become more data-driven, they’re looking to the finance department to become a strategic advisor.

Big data is a big deal for business in the 21st century. The race is on to collect more data, process it into insight, and move ahead of the competition.

The office of finance works with the biggest data in the organization. As businesses seek to become more data-driven, they’re looking to the finance department to become a strategic advisor.

|

|

The Fundamentals of Machine Learning in Finance

Machine Learning vs. Artificial Intelligence

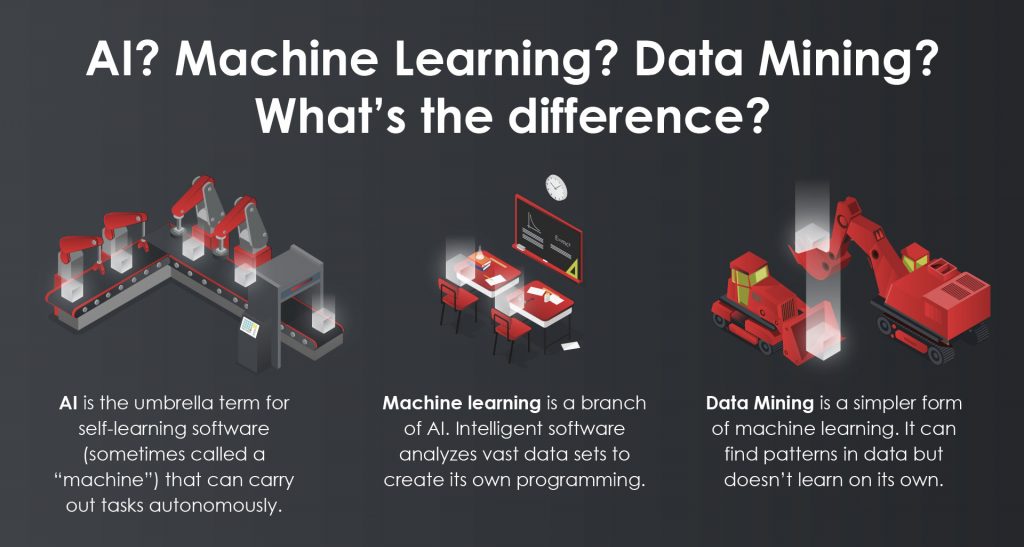

It’s easy to be confused by the terminology around artificial intelligence and machine learning. It’s a new and rapidly-developing technology, and we’re still developing the vocabulary to talk about it. That’s especially true for vendors — marketing plays a role in the language we use as well. Here’s what you need to know. Artificial intelligence and machine learning are often used interchangeably, but they’re slightly different things:- Artificial Intelligence refers to a machine (generally a piece of software) that can adapt to new situations without human instruction. AI machines aren’t limited by what they have been programmed to do.

- Machine Learning is a method for creating machines capable of learning and making their own rules to understand data.

How Does Machine Learning Work?

Machine learning starts with a model, a prediction the system will use to begin learning. This model comes from the human overseeing the process. For example, you might have a prediction that X amount of investment in human resources will bring in Y amount of revenue. That’s the starting point for learning. Next, the machine learner needs data. In this case, it would be historical data of the amount invested in HR and the ROI for each investment. The learner compares the data to the model, evaluating how well it fits, and begins to make refinements to the model. The process then repeats with fresh data. Each go-round, the machine adjusts the model to more closely fit the data. In this case, the machine, would get better at predicting the ROI of human resources investment. It would eventually develop a model far more accurate than a human estimation could be. Note that for this process to work,you need a good model to start with, and plenty of clean, trusted data that is structured so the machine can understand it.

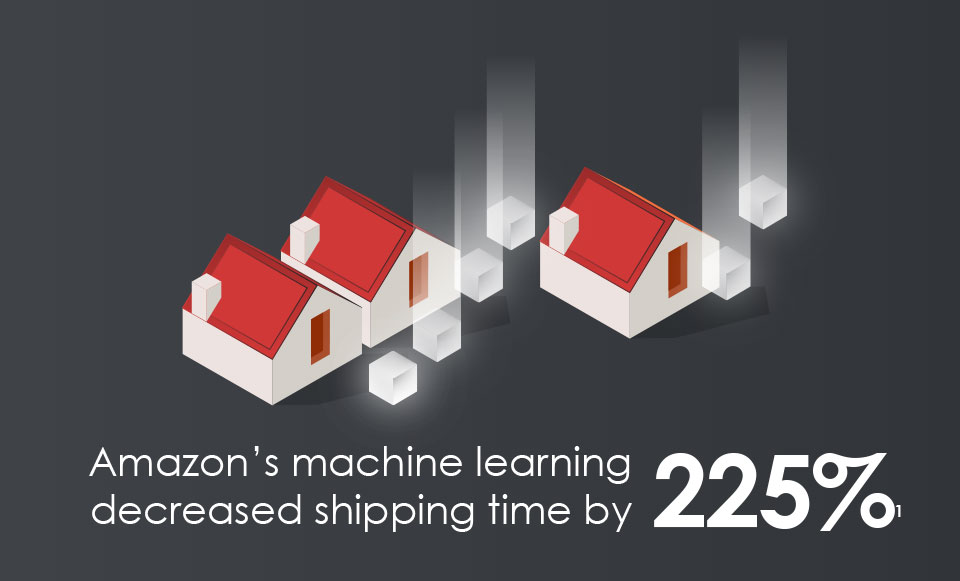

Machine learning usually works with more complex models than our example, of course. Your finance models will have far more than just two types of data to compare. The end results of applying machine learning to complex models can be striking: Amazon’s machine learning algorithm decreased shipping time by 225%.

Note that for this process to work,you need a good model to start with, and plenty of clean, trusted data that is structured so the machine can understand it.

Machine learning usually works with more complex models than our example, of course. Your finance models will have far more than just two types of data to compare. The end results of applying machine learning to complex models can be striking: Amazon’s machine learning algorithm decreased shipping time by 225%.

Getting Started with Machine Learning in Finance

Bringing machine learning into your finance department is a necessary next step — but it’s still a big one that requires careful planning. The first thing you need is the right problem to solve — the right project to serve as your machine learning project. The right project is something that’s essential to your operations, but also time-consuming and repetitive. And machine learning is best applied to processes that deal with data; the more data, the better.

Bringing machine learning into your finance department is a necessary next step — but it’s still a big one that requires careful planning. The first thing you need is the right problem to solve — the right project to serve as your machine learning project. The right project is something that’s essential to your operations, but also time-consuming and repetitive. And machine learning is best applied to processes that deal with data; the more data, the better.

Make your first project a “small bet.” You don’t need to earmark millions of dollars or run the pilot for years at a time. Choose a process that you can try automating with machine learning, get results fast, and either invest more or find a new potential project.

Once you identify the right pilot project, start by gathering, sanitizing, and structuring the data. This may include training your team (and beyond) on data management and hygiene. If your data pipeline isn’t in order yet, that’s a prerequisite. Map the landscape, make sure you’re bringing in trusted data, and start from there.

As you implement the pilot project, it’s important to begin developing a few skills. You don’t have to go get a degree in data science, but you should familiarize yourself and your team with the key concepts and terms. This simple data science glossary is a good first step, while this machine learning glossary gets into more advanced terms.

Make your first project a “small bet.” You don’t need to earmark millions of dollars or run the pilot for years at a time. Choose a process that you can try automating with machine learning, get results fast, and either invest more or find a new potential project.

Once you identify the right pilot project, start by gathering, sanitizing, and structuring the data. This may include training your team (and beyond) on data management and hygiene. If your data pipeline isn’t in order yet, that’s a prerequisite. Map the landscape, make sure you’re bringing in trusted data, and start from there.

As you implement the pilot project, it’s important to begin developing a few skills. You don’t have to go get a degree in data science, but you should familiarize yourself and your team with the key concepts and terms. This simple data science glossary is a good first step, while this machine learning glossary gets into more advanced terms.

Challenges to Machine Learning in Finance

There are three factors to consider during any major change: people, processes and technology. For machine learning, technology is the easy part: The solutions commercially available tend to be customizable, easy to work with, and with a friendly learning curve. That leaves people and processes to get in order. Be prepared to address these three most common challenges:- Data management. As we said, machine learning requires a great deal of high-quality data. The machine is only as good as the data you feed it. Most organizations have a broad and scattered data landscape, across multiple cloud solutions, on-premise, even on individual devices. It’s important to map the data landscape and secure a pipeline of trusted data.

- Resistance to change. Any big change is going to inspire some level of uncertainty. With AI and machine learning there’s even more anxiety; people tend to feel the machines will render them obsolete. Help your team to see machine learning as an enhancement, not a replacement. Machine learning can actually improve their quality of life; they’ll be free to pursue more meaningful, challenging, interesting work of higher value to the organization.

Making a business case. Starting small with a simple pilot project should make for an easier sell. Focus on how the project will help not only increase efficiency, but also shift your team from low-value to high-value tasks.

Making a business case. Starting small with a simple pilot project should make for an easier sell. Focus on how the project will help not only increase efficiency, but also shift your team from low-value to high-value tasks.

Real-World Use Cases for Machine Learning in Finance

Still not sure where to start? The following finance functions are ideal for your first machine learning experiment.

Still not sure where to start? The following finance functions are ideal for your first machine learning experiment.

- Invoicing: Identify missing/incomplete information and automatically contact customers to fill in the blanks.

- Expense claim auditing: Process the bulk of routine claims, identify outliers for human intervention

- Reconciling accounts: Compare data from multiple sources to consolidate.

- Reporting: Compile data from sources to create simple reports

- Fraud detection: Identify unusual patterns/outliers in financial data that might indicate fraud.

Ready for the next evolution? Learn how artificial intelligence will enhance the office of finance with our resource page, Activating Imagination: Artificial Intelligence & Machine Learning in Finance.

Ready for the next evolution? Learn how artificial intelligence will enhance the office of finance with our resource page, Activating Imagination: Artificial Intelligence & Machine Learning in Finance.

Sources:

Sources:

- https://www.callcredit.co.uk/contact-us/campaign-ebook-data-dilemma

- https://www.mckinsey.com/~/media/McKinsey/Industries/Advanced%20Electronics/Our%20Insights/How%20artificial%20intelligence%20can%20deliver%20real%20value%20to%20companies/MGI-Artificial-Intelligence-Discussion-paper.ashx

- https://www.mediapost.com/publications/article/291358/90-of-todays-data-created-in-two-years.html

- https://www.fool.com/investing/2016/06/19/how-netflixs-ai-saves-it-1-billion-every-year.aspx